Key Takeaways

- Sarepta Therapeutics stock plunged ~40% following a second patient death linked to its gene therapy Elevidys .

- FDA may pull Elevidys off the market as safety concerns mount; shipments halted for non-ambulatory patients .

- Therapy initially approved controversially in 2023 for ages 4-5, later expanded amid efficacy debates .

- Year-to-date stock loss exceeds 87%, erasing billions in market value .

- Duchenne muscular dystrophy patients face renewed uncertainty as treatment risks outweigh benefits for some .

The Bloodbath on Nasdaq

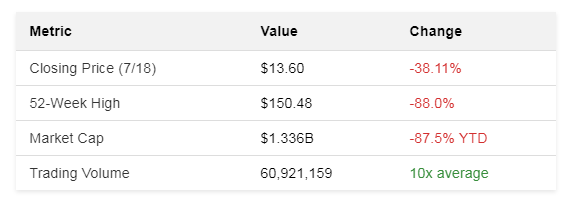

Sarepta Therapeutics stock cratered 40% in premarket trading June 16, 2025. It opened at $13.60, a far cry from its 52-week high of $150.48 . The collapse wasn't a surprise to those watching the ticker. Shares had been dying a slow death all year. By July, the year-to-date loss hit 87.5% . Shareholders stared at ruins.

Trading volume exploded to 60 million shares. Average volume is 5.9 million . The market cap vaporized, $1.336 billion intraday. Down from $19.848B earlier this year . Analysts scrambled. HC Wainwright’s Mitchell Kapoor slashed his target to $10. Deutsche Bank’s David Hoang held at $25. Piper Sandler’s Biren Amin saw $110 as possible. Delusion or vision? Nobody knew .

Table: Sarepta Stock Carnage (June 16-18, 2025)

Two Coffins in the Data

The second death came quietly. Sarepta reported it June 15. Another non-ambulatory Duchenne patient. Acute liver failure. Elevidys swimming in his veins . The first had died in March. Same cause. Same profile .

The company halted shipments for non-ambulatory patients. They paused dosing in the ENVISION trial . Too late. The damage was done. The FDA circled. Commissioner Marty Makary’s team began evaluating whether Elevidys should stay on the market .

Liver warnings existed from day one. The label screamed it: “Monitor liver function weekly for three months.” Common adverse reactions included vomiting, nausea, acute liver injury . Doctors knew. They prescribed anyway. When you face a monster like Duchenne, where boys die in their 20s, gambles get taken .

A Controversial Green Light

Elevidys won accelerated FDA approval June 22, 2023. Only for ambulatory kids aged 4-5. A narrow window. About 400 U.S. patients per year . The price tag? $3.2 million. Second most expensive drug in America .

Peter Marks, head of FDA’s biologics wing, pushed it through. He overruled staff objections . The evidence? Increased micro-dystrophin expression. Not improved motor function. A surrogate endpoint .

“A clinical benefit of Elevidys, including improved motor function, has not been established.”

- FDA Approval Statement, June 22, 2023

The Phase 3 EMBARK trial failed its primary endpoint months later. Treated patients improved 2.6 points on the NSAA scale. Placebo improved 1.9. Statistically insignificant. P=0.24 . Sarepta spun secondary endpoints. Time to rise. 10-meter walk test. Look here, they said. Progress .

Expansion Against the Odds

June 2024. Against logic, the FDA expanded Elevidys’ approval. Ambulatory patients 4 and up. Accelerated approval for non-ambulatory patients .

Peter Marks again. Flexing regulatory muscle. He cited “totality of trends” . Not proof. Trends. The Duchenne community cheered. Finally, they thought. A weapon. Pat Furlong of Parent Project Muscular Dystrophy had called the 2023 approval “the lifelong work of so many” . Now they had more.

Critics hissed. The label expansion ignored EMBARK’s flop. It ignored the March 2025 death. The therapy’s design itself was flawed, it delivered micro-dystrophin, a shortened protein (138 kDa vs. normal 427 kDa) . A bandage on a hemorrhage.

Financial Freefall

Revenue guidance collapsed first. May 2025. Sarepta slashed its 2025 forecast to $2.3-$2.6 billion. Down from $2.9-$3.1 billion . Delayed Elevidys turnaround times, William Blair noted .

The balance sheet bled red. Net income: -$248.39 million. Diluted EPS: -$2.64. Operating margin: -40.3% . Cash reserves dwindled to $522.76 million against heavy debt, 118.73% debt-to-equity ratio .

Class action lawsuits piled up. Levi & Korsinsky. Pomerantz LLP. The Schall Law Firm. All shouting securities violations between June 22, 2023 and June 24, 2025 . Shareholders wanted scalps.

The Patients in the Middle

Duchenne boys don’t have time. Muscle wasting starts at 3-6 years. Wheelchairs come by 12. Most die in their 20s from heart or lung failure . Elevidys promised a detour.

The narrow approval stung. “There’s still significant unmet need,” said Pat Furlong after the 2023 decision. “While the gene therapy approval is thrilling... we have many people younger than 4 and many over the age of 5” .

Now? Two graves. Non-ambulatory kids, the most vulnerable, forbidden from treatment. Sharon Hesterlee of the Muscular Dystrophy Association saw the cruelty: “What can we do for them? It may be a really different strategy... You can’t put [the gene] into muscle that’s not there” .

The FDA’s High-Wire Act

Peter Marks defends accelerated approvals. “In rare diseases, we need something now, not later,” he told a CureDuchenne meeting in May 2024 . He danced around Elevidys’ future.

“In the coming months, we’ll hear more.”

- Peter Marks, FDA CBER Director, May 2024

The FDA faces a brutal choice: Yank a therapy that might help some. Or leave it and risk more deaths. The agency’s credibility sways in the balance. Marks backed Elevidys twice, accelerated approval in 2023, label expansion in 2024, against internal pushback . This third act could break careers.

What Comes Next

Sarepta hunts for solutions. A new immunosuppressive regimen, sirolimus added to corticosteroids, might reduce liver risks . A panel reviews it. The FDA must bless it.

Competitors circle. Capricor’s CAP-1002. REGENXBIO’s RGX-202. Pfizer’s fordadistrogene movaparvovec . All in trials. All watching Sarepta’s wreckage.

Jeffrey Chamberlain at the University of Washington offered a grim epitaph: “This drug is likely the most potent treatment available today... not as robust as many hoped. Approval sets the stage for... improved next generation gene therapies” . Progress paved with small coffins.

Frequently Asked Questions

Why did Sarepta stock drop 40%?

A second patient death linked to Elevidys gene therapy triggered the plunge. FDA may pull the treatment off the market .

Is Elevidys still available?

Only for ambulatory patients. Shipments halted for non-ambulatory patients. Dosing paused in the ENVISION trial .

How many deaths are tied to Elevidys?

Two. Both non-ambulatory patients. Acute liver failure .

Did the FDA ignore safety risks?

Therapy won accelerated approval (2023) and label expansion (2024) despite staff objections and a failed Phase 3 trial .

What’s next for Duchenne treatment?

Competitors like Pfizer and REGENXBIO have gene therapies in Phase 3 trials. Safety and durability questions remain unanswered .

Comments

Post a Comment