Key Takeaways

- India’s iPhone manufacturing costs are ~92% lower than the U.S. due to labor and incentives .

- Apple’s partners like Foxconn and Tata now ship 97% of India-made iPhones to the U.S., dodging China tariffs .

- Skilled workforce shortages and high costs make U.S. iPhone production economically unviable .

- Shifting production to America could triple iPhone prices to ~$3,000 .

- India aims to produce 25–30% of global iPhones by 2025, backed by PLI subsidies .

Why India, Not America, Is Making Apple’s U.S.-Bound iPhones

President Trump’s demand for U.S.-made iPhones clashes with economic reality. See, assembling an iPhone in India costs just $30 per device. In California? $390 . That’s ’cause Indian workers earn ~$230/month—barely 8% of U.S. wages . So when Trump threatened a 25% tariff on imported phones, Apple didn’t blink. Instead, it turbocharged exports from Foxconn’s Tamil Nadu factory, where 97% of production now ships to America . Smart move, ’cause tariffs would’ve added $500 to a China-made iPhone.

Inside Apple’s India Bet: Factories, Jobs, and Billions at Stake

Foxconn’s 300-acre plant in Devanahalli, India, employs 8,000 workers. Gonna hit 40,000 by year-end . Tata Electronics—Apple’s other key partner—snapped up Wistron’s Karnataka facility and a 60% stake in Pegatron’s Tamil Nadu unit . Together, they’ve already exported $4.4 billion worth of U.S.-bound iPhones in 2025’s first five months .

Table: Major Apple Suppliers in India

India’s not just screwing parts together. Companies like Indo-MIM and Centum supply specialized components, creating a full ecosystem .

Why the U.S. Can’t Replicate India’s iPhone Boom (Hint: Workers)

Got 700 job apps yearly from local tech schools near Foxconn’s plant, says Zetwerk exec Josh Foulger . India’s got millions of engineers needing jobs—10 million new roles required yearly for its youth bulge . America? Struggles to fill tooling engineer roles. Tim Cook once joked U.S. meetings for such jobs wouldn’t “fill the room” .

Wages tell the story:

- India: $230/month

- U.S.: $2,900/month (California)

Plus, India’s Production-Linked Incentive (PLI) scheme slashes costs further. Foxconn, Tata, and others get cashbacks for hitting output targets .

Tariffs, Trump, and Tim Cook’s $900 Million Problem

When Trump floated “reciprocal tariffs” in April 2025, Apple chartered planes to airlift $2 billion worth of India-made iPhones to the U.S. . Why panic? ’Cause tariffs could’ve added $900 million to Apple’s June-quarter costs .

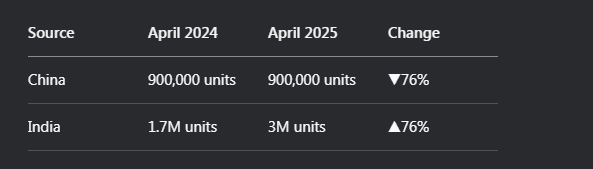

Table: U.S. iPhone Imports Shift (2024–2025)

Apple’s also lobbying Chennai Airport to cut customs clearance from 30 hours to 6 . Every hour saved keeps iPhones tariff-free.

Would U.S.-Made iPhones Really Cost $3,000? Breaking Down the Maths

Analysts agree: iPhones built in America would cost $2,000–$3,500, not today’s $1,000 . Here’s why:

- Labor: U.S. assembly = $390/unit vs. India’s $30 .

- Supply chain: China makes ~80% of components. Moving those factories stateside? Years and billions .

- Scale: Foxconn’s Devanahalli plant will make ~5 million iPhones/year . Matching that U.S. capacity? “Impossible,” says Wedbush’s Dan Ives .

Apple’s profit per iPhone would plummet from $450 to $60 if it absorbed U.S. costs .

The Geopolitical Tightrope: China, India, and Apple’s Future

China’s not letting Apple leave quietly. Reports say Beijing’s blocking high-tech machinery exports to Indian suppliers . Still, Apple’s diversifying fast:

- Vietnam: Making iPads, Macs, Apple Watches .

- India: Targeting 25–30% of global iPhone output by late 2025 .

Trump’s tariff truce with China? Just a “breathing room,” per supply chain experts . Apple’s playing the long game.

Tata and Foxconn: The Local Giants Powering India’s iPhone Dream

Tata Electronics became Apple’s linchpin by acquiring Wistron’s Karnataka plant ($125M) and Pegatron’s majority stake. Now it controls 26% of India’s iPhone output . Foxconn deepened ties via a $433M semiconductor JV with HCL—critical for display driver chips by 2027 .

These partnerships anchor India’s “Make in India” push. Tata alone exported iPhones worth $1.75B in FY2025 .

What Comes Next: 30% iPhones from India, U.S. Price Hikes?

Apple’s roadmap is clear:

- Scale India: From 18% of iPhones in 2024 to 25–30% by 2025 .

- Absorb tariffs: Hike service revenue (iCloud, Apple Music) to offset hardware costs .

- Ignore U.S. manufacturing: “A fairy tale,” says Wedbush’s Ives .

But risks linger. If Trump enacts 55% China tariffs, Apple’s India pivot gets pricier. Component shipping from China to India adds costs .

Frequently Asked Questions

Q: How much cheaper is iPhone production in India vs. the U.S.?

A: ~92% cheaper. $30/unit in India vs. $390 in the U.S. due to lower wages and incentives .

Q: What % of U.S. iPhones now come from India?

A: 76% of U.S. iPhone imports in April 2025 were from India (3 million units), versus 24% from China .

Q: Could Apple make iPhones in America if forced?

A: Technically yes, but profit/unit would drop from $450 to $60. iPhones could cost $3,000 .

Q: How is India supporting Apple’s manufacturing?

A: Via Production-Linked Incentives (PLI)—cash subsidies for hitting output targets—plus engineering talent pipelines .

Q: Will iPhones get more expensive due to tariffs?

A: Likely. Apple may raise prices in late 2025 to offset $900 million in tariff costs .

Comments

Post a Comment