Murkowski Amendment: Ease Solar & Wind Tax Credit Phaseout with Construction Start Rule vs. 2027 Deadline | Inflation Reduction Act

Key Takeaways

- Murkowski’s Amendment shifts wind/solar tax credit eligibility from operational deadlines to construction start dates, easing project timelines .

- Senate GOP Bill accelerates phaseouts for wind/solar credits (2027) but extends nuclear/hydro/geothermal credits to 2036 .

- New Excise Tax penalizes post-2027 wind/solar projects using Chinese materials, increasing costs by 10–20% .

- Industry Backlash: Solar shares fell sharply; critics warn of job losses, higher energy bills, and grid instability .

- Political Divide: Trump backs strict phaseouts; Murkowski and Tillis dissent, citing regional harm and rushed policy .

Lisa Murkowski’s Bid to Soften GOP’s Wind and Solar Tax Credit Cuts

Alaska Senator Lisa Murkowski is pushing hard to change part of the Senate Republicans' big tax bill. She wants to help wind and solar projects keep their tax credits longer. Right now, the bill says projects must be up and running by the end of 2027 to get these credits. Murkowski says that’s way too soon. Her idea? Let projects qualify if they just start building by 2027. For places like Alaska, where weather and logistics slow things down, this could mean the difference between moving forward or shutting down. She’s called the current language “disastrous” for her state .

This isn’t just about Alaska though. Nationwide, developers need years after starting construction to finish big wind or solar farms. Forcing them to complete everything by 2027 could kill projects already in the pipeline. Companies like NextEra Energy—America’s biggest wind and solar developer—have tons of projects that began prep work in 2025. They’d lose their credits if the Senate’s version becomes law . Murkowski’s tweak aims to give these projects breathing room.

The Senate is racing through votes this week, including a marathon “vote-a-rama” session. That’s where Murkowski plans to introduce her change. But she’ll face pushback from conservatives who want those credits gone ASAP .

What the Senate GOP Bill Does to Clean Energy Incentives

Let’s break down the bill’s fine print. First, it treats renewables very differently:

- Wind and Solar: Full tax credits phase out by 2028. Projects must be operational by 12/31/2027 .

- Nuclear, Hydro, Geothermal: Get 100% credits until 2033, then phase down to zero by 2036 .

Table: Tax Credit Phaseout Timelines

Republicans argue wind and solar are “mature” and don’t need help anymore. But critics say the bill picks winners—favoring “always-on” energy sources (like nuclear) that the Trump administration prefers .

The bill also slashes consumer credits:

- EV Tax Credits: End for most buyers after September 30, 2025 .

- Home Upgrades: No more credits for rooftop panels or efficiency upgrades .

And there’s a nasty surprise: a new excise tax on wind/solar projects finished after 2027 if they use parts from China. Companies would need detailed paperwork proving their supply chains are “clean.” Analysts think this tax alone could hike project costs by 10–20% .

Why the “Construction Start” Deadline Matters More Than You Think

Switching from an “operational” to a “construction start” deadline isn’t just semantics. For renewables, it’s everything. Starting construction means spending money on engineers, land permits, and equipment. Actually finishing? That takes years of building transmission lines, installing turbines, and passing inspections.

- Timeline Crunch: Under the Senate bill, a solar farm starting construction today would need to be fully online by 12/31/2027. Industry experts say that’s nearly impossible for large-scale projects. Murkowski’s fix would lock in credits at the start, giving developers 3–5 years to complete work .

- Investor Certainty: Banks fund projects based on guaranteed credits. If those credits vanish mid-build (because delays push completion past 2027), financing dries up. Solar Energy Industries Association warns this could cancel 75 gigawatts of planned clean power .

Alaska’s remoteness magnifies these problems. Short construction seasons, frozen ground, and supply chain snarls make fast turnarounds unrealistic. Murkowski knows this—and she’s not alone. Utilities nationwide fear rushed deadlines will leave them short on power as data centers and factories drive up electricity demand .

Opposition From All Sides: Industry, Experts, and Even Pro-Fossil Voices

The backlash to the Senate bill is fierce—and coming from unexpected places.

- Solar/Wind Companies: Shares of U.S. solar firms nosedived after the bill dropped. The Solar Energy Industries Association blasted GOP senators, saying they’d “have to answer” for higher energy bills and job losses .

- Elon Musk: Trump’s ally called the bill “insane,” warning it would “destroy millions of jobs” and advantage China .

- Alex Epstein: A pro-fossil fuel thinker advising Republicans, even he opposed the surprise excise tax: “Not something I would support” .

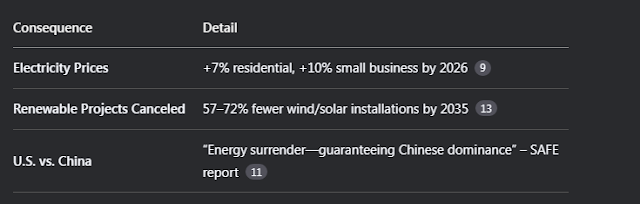

Table: Estimated Impact of Tax Credit Repeals

Even utility groups like the Edison Electric Institute admit the Senate’s tweaks are “a step in the right direction” but still risky. They’d rather see longer timelines to keep the grid stable .

The Politics: Murkowski vs. Trump and GOP Hardliners

Murkowski’s amendment faces long odds. Why?

- Trump’s Influence: The ex-president wants the credits gone fast. House Majority Leader Steve Scalise insists the Senate’s version is already too soft: Trump is “more aggressive in getting rid of it” .

- Budget Tricks: Republicans used a “current policy baseline” to hide $3.8 trillion in tax cut costs. Democrats called it “fake math,” but the tactic passed 53-47 . That makes adding any credit back tough.

Still, Murkowski has allies. Senator Thom Tillis (R-N.C.) slammed the bill as “half-baked,” especially the energy parts. He blamed “philosophers in think tanks” (a dig at Alex Epstein) for writing rules without industry experience. Tillis plans to vote no—a rare GOP defection .

The bottom line? Murkowski’s amendment needs support from moderates to have a shot. If it fails, states with harsh climates or big solar/wind pipelines—like Alaska, Texas, or North Carolina—could face project shutdowns. And with the “vote-a-rama” underway, her clock is ticking .

What’s Next for Renewable Energy If the Bill Passes

If the Senate bill becomes law without Murkowski’s changes, brace for impact:

- Short-Term Chaos: Solar/wind projects not finished by 12/31/2027 lose credits. Developers might cancel anything that can’t meet that deadline .

- Excise Tax Headaches: Post-2027 projects using Chinese materials pay a new tax. Companies must track every battery, turbine, and wire’s origin. Smaller developers could get priced out .

- Winners and Losers: Nuclear and hydro plants win big with credits until 2036. But the U.S. loses ground in solar/wind—exactly where energy demand is soaring .

The clean energy industry isn’t giving up. They’re lobbying moderates hard, warning of price hikes and blackouts. As one analyst put it: “This is how you kill an industry” .

Frequently Asked Questions

What’s the difference between Murkowski’s amendment and the current Senate bill?

The bill requires wind/solar projects to be operational by 12/31/2027 for tax credits. Murkowski’s change lets projects qualify if they start construction by then—a big difference for multi-year builds .

Why does Murkowski call the bill “disastrous” for Alaska?

Alaska’s extreme weather and remote sites make fast construction impossible. The 2027 deadline would exclude most Alaskan projects from credits .

How would the excise tax on Chinese materials work?

Projects finished after 2027 pay a tax if they use parts from “foreign adversaries” like China. Companies must prove compliance via complex paperwork. Costs could rise 10–20% .

Could this bill actually raise electricity prices?

Yes. Studies show repealing solar/wind credits could hike residential bills by 7% and small business bills by 10% by 2026. Fewer projects mean less supply as demand grows .

Is there any chance the amendment passes?

It’s an uphill fight. Trump opposes extending credits, and GOP leaders used budget tricks to force cuts. But Murkowski and Tillis are pushing back, arguing for grid stability and jobs .

Comments

Post a Comment