Key Takeaways

- Global indices show broad recovery in H1 2025, led by Hong Kong’s Hang Seng (+23.4%) and Germany’s DAX (+19.5%) .

- U.S. benchmarks like the S&P 500 hit record highs near 6,285, driven by strong earnings (77% beat rate) .

- Small/mid-caps underperformed: S&P SmallCap 600 fell 5% YTD vs. large caps .

- Emerging markets diverged sharply: Kenya’s NSE 20 surged 47.9%, while Egypt’s EGX30 lagged .

- Volatility dropped (VIX at 16.5), but trade tensions and rate shifts pose summer risks .

The Global Dashboard: Your Real-Time Market Compass

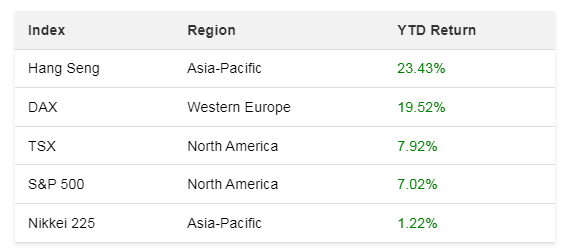

A global stock indices quote dashboard is your cockpit for navigating financial markets. Think of it like a live weather map, but for money movements. It pulls real-time data from exchanges worldwide—New York, Frankfurt, Tokyo—and displays shifts in key benchmarks like the S&P 500 or Germany’s DAX . Why’s this matter? Cuz trends in Paris can ripple to São Paulo in hours. In H1 2025, all nine major indexes tracked by dshort posted gains, with Hong Kong’s Hang Seng spiking 22.67% . A dashboard surfaces these leaders and laggards instantly. You’d see Canada’s TSX up 7.87% while Japan’s Nikkei inched just 1.49% higher. Without this lens, you’re trading blind.

Regional Rundown: Who’s Hot and Who’s Not

Let’s break down regional performances so far in 2025. Asia’s a mixed bag: Hang Seng’s 23.4% surge contrasts with Nikkei’s 1.2% crawl . Europe’s strength stunned everyone—Germany’s DAX rocketed 19.5% on stimulus hopes, while France’s CAC 40 limped at 4.9% . Over in the Americas, the S&P 500’s 7% gain masked pain in small-caps (Russell 2000 +0.5%) . Canada’s TSX, heavy with global miners/oil firms, climbed 7.9% despite recession fears . Wild cards? Venezuela’s IBC exploded 209% amid hyperinflation, while Kenya’s NSE 20 jumped 47.9% on tech inflows .

Table: YTD Returns of Major Indices (as of July 3, 2025)

What’s Moving Markets: Tariffs, Tech, and Tremors

Three forces are shaking markets right now. First, trade policy whiplash. Trump’s “Liberation Day” tariffs sparked April’s sell-off, but pauses revived stocks . China tariffs still loom though—watch Shanghai Composite (up 5.9%) for tremors . Second, tech’s double edge. NASDAQ 100 soared 9% YTD as AI firms like Nvidia (+26%) led, but chip export curbs hurt some suppliers . Third, rate cuts vs inflation. Canada slashed rates 225bps, propping TSX; the BoC may cut further if unemployment hits 7% . Meanwhile, U.S. jobs data (147K June payrolls) eased recession fears, lifting the Dow .

Sector Deep Dive: It’s Not Just the Index

Not all sectors ride the same wave. Momentum stocks crushed it in 2025—think AI darlings in the S&P 500 Momentum Index, which outpaced the broader market by 10% . High-beta (volatile) and low-volatility stocks both beat the S&P 500 by 2%, but through opposite paths. Tech-heavy high-beta names surged post-April, while low-volatility plays like utilities held early gains . Check energy: Exxon dipped 0.9% as oil gyrated, while Brazil’s Bovespa (+25% in USD) rode commodity lifts . Moral? Your dashboard needs sector filters. A 19% DAX rally means little if you’re in lagging German DivDAX stocks (+8.4%) .

Expert Moves: How Pros Are Playing It

Russell Investments’ midyear playbook reveals smart shifts. They turned less bullish on U.S. exceptionalism, favoring European (S&P Europe 350 beat S&P 500 by 15% in Q1) and Latin American (S&P Latin America 40 +11% Q2) diversification . Why? The dollar’s “historically expensive,” and hedging costs rose. For Canada, they’re neutral stocks but love gov bonds for defense . Active managers also chase factor rotations—leaning into momentum post-tariff panic—and earnings surprises. 77% of S&P 500 firms beat Q2 estimates; Datadog spiked 10% on index inclusion .

Table: Regional Performance vs. U.S. Benchmarks

_Est. from Q1-Q2 data in _Dashboard Hacks: Metrics That Matter Beyond Price

Beyond index levels, track these live gauges. Volatility: VIX slid to 16.5 by July, signaling calm after April’s 50+ spike . Low VIX often precedes summer dips as traders get complacent. Currencies: The U.S. Dollar Index fell 11% YTD, boosting eurozone returns for USD investors . Breadth: U.S. large-caps rallied, but NYSE US 100’s flat line hints at narrow participation . Earnings beat rates: At 77%, it’s above the 73% avg—supporting prices . Pro tip: Overlay relative strength (e.g., DAX vs FTSE 100) to spot regional rotations.

Risks Ahead: Summer Storms on the Radar

June’s calm may not last. Three clouds loom:

- Trade deadlines: 20% tariffs on Vietnam start soon; talks are “stalled” . If talks fails, tech supply chains (seen in KOSPI volatility) could suffer.

- Rate cut bets: Markets price 50bps of BoC cuts, but Russell sees “overly conservative” expectations—more cuts could sink the CAD .

- Geopolitical shocks: Mideast tensions could spike oil, pressuring Eurozone utilities (CAC 40’s weakest sector) .

The VIX curve suggests caution. Liquidity thins in August as traders vacation, amplifying shocks. As Russell’s Paul Eitelman notes: “Volatility is down, but if it resurfaces, diversification [...] delivers a smoother ride” .

Building Your Watchlist: Indices for Every Strategy

Tailor your dashboard to your style:

- Growth traders: Track NASDAQ 100 (tech) and TecDAX (+12.9% YTD) for AI plays .

- Dividend hunters: Eye UK’s FTSE 100 (steady 4% avg yield) or Canada’s TSX (energy/mining payouts) .

- Emerging market speculators: Watch Kenya’s NSE 20 (+47.9%) or India’s SENSEX (flat YTD but cheap) .

- Defensive folks: Low-volatility ETFs or Swiss SMI (-0.8% YTD but stable) .

Always cross-check with macro drivers. For example, Brazil’s Bovespa correlates with iron ore prices—so add commodity feeds to your layout.

FAQs: Your Dashboard Questions Answered

Q: How often do global indices update?

Major ones (S&P 500, DAX) refresh every 15-30 seconds during trading hours. After-hours futures fill gaps .

Q: Which index had the best 2025 so far?

Hong Kong’s Hang Seng, up 23.4%. Venezuela’s IBC gained 209%, but hyperinflation distorts this .

Q: Why track the VIX?

It gauges fear. When VIX spikes (like April’s >50 reading), markets often bottom shortly after .

Q: Are small-caps worth watching now?

Not yet. The Russell 2000 rose just 0.5% YTD vs S&P 500’s 7%. Wait for improving breadth .

Q: How do tariffs affect indices?

They hit export-heavy indexes. Germany’s DAX (40% export weight) fell 8% in April on tariff news before rebounding .

Comments

Post a Comment