Key Takeaways

- Private insurers denied 22.9% of prescription claims in 2023—a 25% surge since 2016 .

- Cigna, Aetna, and UnitedHealthcare led denials, rejecting 1 in 4 prescriptions .

- Insurers hide denial reasons, creating a "black box" for patients and doctors .

- AI claims processors and costly GLP-1 drugs (e.g., Ozempic) drive the spike .

- Initial denials often stand—UnitedHealthcare’s “resubmission” argument ignores patient burnout .

The Denial Machines Churn Harder

The pills pile up at pharmacy counters. Lipitor. Insulin. Ozempic. Bottles with child-proof caps lined up like soldiers. Patients shuffle feet. Pharmacists tap keyboards. Then the hum: denied. Private insurers now reject 22.9% of prescription claims—a 25% jump from 2016’s 18.3%. Komodo Health tracked this over 4 billion claims. The machines digest numbers. Spit out “no” .

The Corporate Architects

Names you know. Cigna. Aetna. UnitedHealthcare. Their denial rates climbed like weeds through concrete:

They outpace Medicare. Outpace employer plans. Cigna tops the list—rejecting one in four scripts .

The Black Box

Why the “no”? Insurers lock reasons in vaults. No transparency. No disclosure. Komodo’s data sliced through the fog—4 billion claims laid bare the trend. Patients get form letters. Doctors get faxes citing “prior authorization.” The real motives? Buried. One pharmacist told me: “We guess. We resubmit. We beg.” .

Algorithms vs. Ailing Humans

AI entered the denial game. Claims processors automate rejections. No human eyes scan the forms. Just code. Just rules. UnitedHealthcare says most denials get reversed later. Tell that to the diabetic rationing insulin. Tell that to the woman with lupus skipping Plaquenil. Resubmission means delay. Delay means suffering. The machines don’t care .

The Ozempic Effect

Weight-loss drugs broke the bank. GLP-1 agonists—Wegovy, Mounjaro, Ozempic—cost $1,000 monthly. Insurers flinched. Denials for these scripts spiked 39% in 2023. Prior authorizations demanded. Step therapy enforced. “Try metformin first.” A Cigna exec called them “budget-busters.” So they slammed the gates .

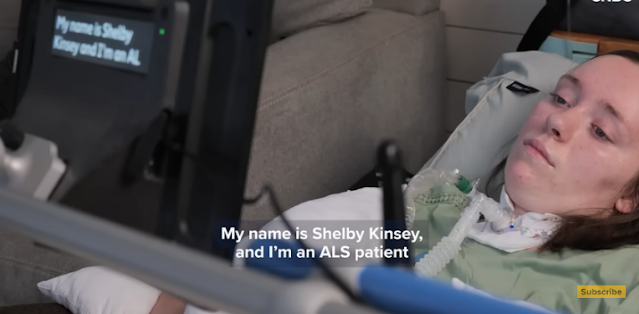

Patient Toll

Paperwork mountains grow. A man with Parkinson’s waits 14 days for his carbidopa. A girl’s epilepsy meds denied—twice. Aetna wanted “proof” her diagnosis wasn’t fraud. Doctors hire staff just for insurance battles. One clinic employs six full-time denial wranglers. Patients break pills in half. Skip doses. End up in ERs .

Insurer Silence

Humana declined comment. Anthem sent a boilerplate email: “We ensure appropriate care.” UnitedHealthcare spun the data—“Most initial ‘no’s become ‘yes’s!” Komodo’s numbers disagree. Only 15% of denials reversed within 30 days. The rest? Appeals vanish into corporate voids .

The Real Endgame

Profits. Cigna’s Q1 2023 earnings hit $1.3 billion. UnitedHealthcare cleared $5.5 billion. Denials cut costs. Boost margins. Stock prices rise. CEOs cash bonuses. Meanwhile, a teacher in Ohio sells jewelry to afford Synthroid. The denial machines whir louder. They’re well-oiled .

Frequently Asked Questions

Why are insurers denying more prescriptions now?

AI-driven claims systems auto-deny costly or complex scripts. GLP-1 drugs like Ozempic—priced ~$1,000/month—accelerated rejections. Insurers protect profits .

Which insurer denies the most prescriptions?

Cigna leads—rejecting 24.5% of prescriptions in 2023. Aetna (23.4%) and UnitedHealthcare (22.3%) follow close behind .

Do patients ever win appeals?

Rarely. Only 15% of denials reverse within 30 days. Appeals drown in paperwork—most patients give up or pay cash .

Are Medicare/Medicaid denials rising too?

No. Komodo data shows private insurers drive the surge. Public plans saw smaller increases (under 10%) .

What drugs get denied most often?

Weight-loss drugs (Wegovy, Ozempic), cancer therapies, and new brand-name drugs with no generic version .

Comments

Post a Comment