Key Takeaways

- Microsoft cuts 9,000 jobs (≈4% of workforce) in latest restructuring, part of 2025 trend targeting management layers and cost efficiency .

- Gaming division hit hardest: Xbox studios like King (200 jobs cut), ZeniMax, and Rare affected; Everwild game canceled .

- Layoffs follow strong profits: $25.8B net income reported, even as company spends $80B on AI/data centers .

- 4th major cut in 18 months: Over 15,000 gaming jobs eliminated since Activision Blizzard acquisition .

Inside Microsoft’s Latest 9,000 Job Cuts: Strategy, Impact, and Industry Shifts

1 Why Microsoft Is Cutting Jobs Despite Record Profits

Microsoft confirmed layoffs affecting 9,000 employees this week. That’s about 4% of its global workforce. The company reported $25.8 billion in net income recently—an 18% year-over-year jump . So why cut jobs when profits are strong?

It’s about what CFO Amy Hood calls "reducing layers with fewer managers" . Like Amazon and Meta, Microsoft aims for a flatter structure. They want quicker decisions as tech shifts toward AI. This isn’t about saving money short-term. Microsoft plans to spend $80 billion this fiscal year on data centers and AI infrastructure . The cuts help fund those bets.

Employees knew changes were coming. One source told IGN staff "braced themselves," fearing the worst after earlier 2024 cuts .

2 Gaming Division Absorbs Major Blows

Xbox, King, and ZeniMax teams faced deep cuts. King’s Barcelona office lost 200 jobs (10% of its staff) . ZeniMax marketing teams in London and Maryland also saw reductions .

Most notably, Rare’s Everwild—in development since 2019—was canceled . Xbox chief Phil Spencer explained the move in a staff memo:

"We will end or decrease work in certain areas...and follow Microsoft’s lead in removing layers of management to increase agility" .

This marks the fourth major gaming division restructuring since January 2024 :

- January 2024: 1,900 jobs cut (mostly Activision Blizzard)

- May 2024: Studio closures (Arkane Austin, Tango Gameworks)

- September 2024: 650 additional roles eliminated

- July 2025: 9,000 company-wide (gaming heavily impacted)

3 Financial Context: Profits Meet Restructuring

Microsoft’s cuts seem contradictory amid record performance. Look closer, though:

- Revenue: $70 billion (March 2025 quarter)

- Net income: $25.8 billion (18% YoY growth)

- Stock price: Near all-time highs (~$449)

Yet cloud margins are tightening as AI infrastructure costs soar . CEO Satya Nadella hinted at changes back in April:

"At a time of platform shifts, you want to lean into new design wins...not keep doing stuff from the previous generation" .

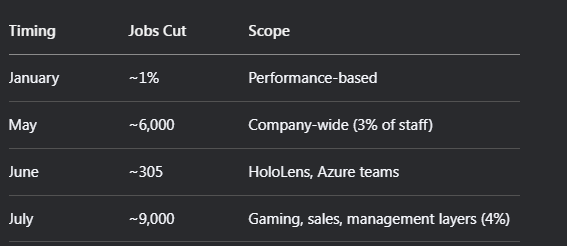

Table: Microsoft Layoff Rounds in 2025

4 How Management Layers and Locations Factor In

Microsoft explicitly tied these cuts to flattening hierarchies. Fewer managers between executives and staff should boost "agility and effectiveness" .

Geographically, U.S. teams (Washington, California) and European offices (King, ZeniMax) absorbed most hits . India operations stayed untouched—Microsoft plans a $3 billion AI investment there .

Sales and marketing roles were also trimmed. Why? AI tools like Copilot automate tasks previously handled by humans .

5 Support for Impacted Employees

Microsoft offers standard severance: pay, healthcare, and job placement resources "aligned with local laws" . Laid-off staff get priority review for open Microsoft Gaming roles .

Morale is a concern. Multiple employees told The Verge that performance-based cuts earlier "seriously hit morale" . Spencer acknowledged the human toll:

"These decisions are not a reflection of the talent, creativity, and dedication of the people involved" .

6 Broader Tech Industry Layoff Trend

Microsoft isn’t alone. Tech firms announced 76,214 cuts in 2025—up 27% YoY .

- CrowdStrike: 5% workforce reduction

- Meta: Trimming "lowest performers"

- Google/Alphabet: Hundreds cut last year

- Amazon: Ongoing cuts in devices/books divisions

AI disruption and economic uncertainty drive this . Companies prioritize efficiency during heavy tech transitions.

7 Strategic Shifts Behind the Cuts

Microsoft’s actions reveal three strategic pivots:

- AI over legacy projects: $80 billion allocated to AI/data centers

- Simpler org structure: Fewer managers, faster execution

- Gaming focus on "strategic growth": Killing Everwild, protecting "thriving" areas

As Spencer told staff:

"We must make choices now for continued success...and concentrate effort on areas with greatest potential" .

8 What’s Next for Microsoft and Employees

Expect more focus on Azure AI, Copilot, and cloud services. Xbox will likely prioritize established franchises (Call of Duty, Candy Crush) over riskier projects like Everwild .

Laid-off workers face a mixed job market. Tech layoffs are rising, but AI expertise remains in demand. Microsoft’s severance package offers temporary stability .

Long-term, Microsoft’s bet is clear: short-term pain for AI-driven growth. Investors seem to agree—shares dipped just 0.6% on the news .

Frequently Asked Questions

Q: How many Microsoft employees lost jobs in 2025?

A: Over 15,000 across January (1%), May (6,000), June (305), and July (9,000) rounds .

Q: Which teams faced the deepest cuts?

A: Gaming (Xbox, King, ZeniMax), sales/marketing, and middle management .

Q: Did Microsoft cancel any game projects?

A: Yes. Rare’s Everwild, announced in 2019, was canceled .

Q: Why cut jobs while making $25.8 billion profit?

A: To fund $80 billion AI investments and simplify management structure .

Q: What severance are laid-off staff receiving?

A: Pay, healthcare coverage, and job placement support "aligned with local laws".

Citing My Link Sources:

- https://techcrunch.com/2025/07/02/microsoft-will-lay-off-9000-employees-or-less-than-4-of-the-company/

- https://www.cbsnews.com/news/microsoft-layoffs-9000-workers/

- https://www.geekwire.com/2025/microsoft-cuts-another-4-of-its-workforce-about-9000-jobs-in-continued-push-for-efficiency/

- https://www.theverge.com/news/693535/microsoft-layoffs-july-2025-xbox

- https://www.windowscentral.com/gaming/xbox/microsoft-xbox-layoffs-july-2025

- https://www.ign.com/articles/microsoft-makes-significant-layoffs-across-gaming-division-xbox-boss-phil-spencer-confirms-in-memo-to-staff

- https://www.cnbc.com/2025/05/13/microsoft-is-cutting-3percent-of-workers-across-the-software-company.html

- https://finance.yahoo.com/news/microsoft-lay-off-many-9-130226839.html

- https://economictimes.indiatimes.com/news/international/us/microsoft-layoffs-hit-9000-in-new-round-job-cuts-span-teams-and-locations-heres-whos-affected/articleshow/122208529.cms?from=mdr

- https://www.eurogamer.net/microsoft-begins-substantial-layoff-process-across-gaming-division-king-and-zenimax-impacted

Comments

Post a Comment