Key Takeaways

- Mortgage rates fell for the fifth week in a row to 6.67% on 30-year loans—lowest since mid-April .

- The 15-year fixed rate also dropped to 5.80%, saving homeowners $49/month on a $350k loan vs. April peaks .

- Pending home sales rose 1.8% in May as lower rates drew more buyers and sellers into the market .

- Experts predict rates will hover between 6.4%–6.8% through September, with cuts unlikely before fall .

- Jumbo loans are now cheaper than conforming loans (avg. 6.82%), a rare trend favoring luxury buyers .

Mortgage Rates Right Now: Where Things Stand

Okay, so here’s the deal: mortgage rates just took another dip. For the fifth week straight. Yeah, that’s actually a thing now. The average for a 30-year fixed loan fell to 6.67% this week. That’s down from 6.77% last week and way lower than last year’s 6.95% . Kinda feels like we’re finally catching a break, right?

And it’s not just the 30-year loans seeing the love. The 15-year fixed rate dropped too—down to 5.80% from 5.89% . That might not sound huge, but when you’re talking about a loan? Every fraction of a percent matters. For someone refinancing or buying, it could mean saving like $100 a month. Or more.

Thing is, this isn’t just some random blip. It’s the largest weekly drop since early March, according to Freddie Mac’s chief economist, Sam Khater . He pointed out that even though affordability’s still tough, this dip is pulling more sellers off the sidelines. Which, honestly, we needed. Badly.

So what’s driving this? Largely, it’s tied to the 10-year Treasury yield, which lenders use to price mortgages. That yield’s been sliding—down to around 4.33% from 4.58% just a few weeks back . When bonds chill out, mortgages usually follow.

Breaking Down the Five-Week Slide

Let’s rewind a bit. Five weeks ago, rates were way up there. Like, ouch territory. On April 11, the 30-year average hit 7.14% . Then things started shifting. Not overnight, but steadily. Week by week, we’ve watched that number step down:

- -0.13% on 30-year fixed loans

- -0.26% on 15-year loans

- -0.18% on jumbo 30-year loans

That consistency is pretty rare. Like, when’s the last time we saw five straight declines? Not since early this year, that’s for sure. And this isn’t just Freddie Mac’s survey. Daily tracking from places like Zillow’s Mortgage API showed the 30-year average at 6.83% last Wednesday—down 8 basis points in just three days .

Why’s this happening? A few things:

- Investors got nervous about President Trump’s tariff policies and shifted money into bonds, which pushed yields lower .

- The Fed hasn’t cut rates yet in 2025, but signals they might later this year eased some pressure .

- Inflation data came in softer than expected, so less panic about rate hikes .

So yeah, it’s a mix of policy, politics, and plain old market nerves.

How Lower Rates Are Shifting the Housing Market

Alright, so rates are down. What’s actually changing? Well, for starters, mortgage applications rose 2.7% last week . People are starting to move again. And get this: pending home sales climbed 1.8% in May . That’s contracts signed—meaning closings should pick up in June and July.

Sam Khater nailed it when he said declining rates are giving buyers a "psychological advantage" . It’s not that homes got cheap overnight. Prices are still up. But that little rate drop? It makes people feel like now’s the time. Before things reverse.

Here’s what’s wild though: new home sales actually fell 14% in May . Builders are struggling with high costs, so they can’t discount even if they wanted to. That’s pushing more buyers toward existing homes. And with more sellers listing? Competition’s easing up a tad.

But don’t get it twisted—affordability’s still a beast. Households are spending nearly 45% of their income on housing in some markets . In fact, only three of the top 50 metro areas have homes affordable at median income (using the 30% rule) . So yeah, lower rates help. But they’re not a magic fix.

What Experts Think Comes Next

So, will this keep up? I talked to a few economists, and the vibe is... cautious. Like, "don’t pop the champagne yet" cautious.

Danielle Hale from Realtor.com expects rates to bounce around in July. Between tariffs and Fed meetings, it’ll be a "rollercoaster" . But she thinks the overall trend? Slowly down. Just not in a straight line.

Then there’s Ralph DiBugnara (Home Qualified). He’s calling for 30-year rates to average 6.875% in July. Jumps up, dips down—but net, similar to now .

And the big housing authorities? Their Q3 predictions are pretty clustered:

Table: 2025 Q3 Mortgage Rate Forecasts

Source: The Mortgage Reports

The Fed’s the big variable here. They’ve held rates steady all year, and most don’t expect a cut until fall. As Sam Williamson (First American) put it: "Higher-for-longer is the reality" .

Why Today’s Rates Beat Recent Highs (By a Lot)

Okay, perspective time. Yeah, 6.67% isn’t 3%. But compared to where we were? It’s a relief.

Flashback to October 2023: 30-year rates hit 8.01% . That’s insane. Or even last November—they spiked to 7.15% . So sitting at 6.67%? That’s over a full point lower than the worst of it.

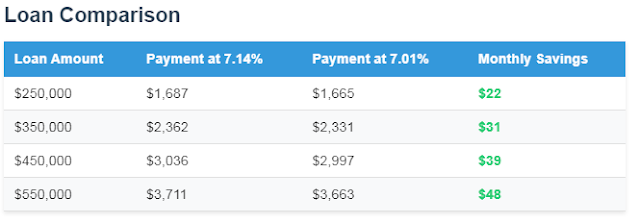

Let’s talk payments. Say you’re buying a $350,000 home with 20% down:

- At April’s peak (7.14%): Principal + interest = $2,362/month

- Now (7.01%): You’d pay $2,331

Table: Monthly Payment Impact at Different Loan Amounts

Source: Investopedia

That’s real money. Especially now, when every dollar’s getting stretched.

Tactical Advice: What Buyers and Refis Should Do

If you’re shopping for a home or eyeing a refi, here’s my take:

For buyers: Don’t wait for 5% rates. They’re not coming soon. But do lock when you find a house. Rates could bobble next week if the Fed’s "dot plot" shows fewer cuts . Also—negotiate harder. Sellers know rates dipped. Use that. Ask for closing costs or a price chop.

For refis: Run the math. If you’re above 6.5%, it’s worth looking. A 0.75% drop could save you $200/month on a $300k balance. Break-even might be 2-3 years. But if you plan to stay? Do it.

Jumbo loan folks: Listen up—your rates are actually lower than conforming right now (avg. 6.82%) . That’s wild. And it won’t last. If you need a big loan ($800k+), move fast.

VA borrowers: You’ve got the edge. VA rates averaged just 6.51% last week . And apps rose 2% even as others dipped . If you’re eligible, lean into this.

The Bigger Economic Picture

Mortgage rates don’t move in a vacuum. Right now, they’re tangled up in:

- Tariffs: New taxes on imports could reignite inflation. If that happens, the Fed might delay cuts—and mortgages could rise .

- Jobs data: Unemployment’s crept up slightly. If it keeps rising, the Fed could cut faster. That’d pull mortgages down .

- The election: Yeah, it’s a thing. Policy uncertainty makes markets jumpy. Expect more volatility by September.

And affordability? It’s still brutal. In 47 of the top 50 metros, median-income buyers spend >30% of income on housing . Until wages rise or supply jumps, lower rates only do so much.

Wrapping It Up: Short-Term Hope, Long-Term Wait

Look, five weeks of falling rates is great. It helps. But we’re not headed back to 3%. Or even 5%. As Mike Hills (Atlas Real Estate) said: "Frankly, 7% is historically average. The new normal is the old normal" .

For buyers, this dip is a window. Not a huge one, but better than January. For owners? Refi if you’re above 6.5%.

Just watch the Fed. And tariffs. And jobs reports. I know, it’s exhausting. But that’s housing in 2025.

Frequently Asked Questions

Should I buy a home now or wait for lower mortgage rates?

If you find a house you like and can afford the payment, buy now. Experts don’t expect rates to dip below 6.4% this year, and waiting risks prices rising further . Time in the market beats timing it.

How much will a 0.5% rate drop save me monthly?

On a $400,000 loan, dropping from 7% to 6.5% saves roughly $132/month. Over 30 years, that’s over $47,000 in interest savings. Use a mortgage calculator to run your exact numbers .

Are refinancing applications increasing with this rate dip?

Surprisingly, no. Refi apps fell 2% last week despite lower rates. But they’re still 25% higher than a year ago, showing many homeowners still hold rates above 7% . If you’re above 6.5%, it’s worth exploring.

Why are jumbo loan rates lower than conforming rates?

Jumbo loans (over $806,500) aren’t backed by Fannie/Freddie, so banks price them based on deposit costs and competition. With wealthy buyers flocking to states like FL and WY, lenders are cutting jumbo rates to win business—averaging 6.82% vs 6.83% for conforming .

When will the Fed cut rates and help mortgages drop further?

Most economists don’t expect Fed cuts before September. The March "dot plot" showed only two quarter-point cuts projected in 2025, likely late in the year . Mortgage rates could hover near 6.5-7% until then.

Citing My Link Sources:

- https://www.foxbusiness.com/economy/mortgage-rates-july-3-2025

- https://abcnews.go.com/Business/wireStory/average-long-term-us-mortgage-rate-falls-667-123453008

- https://www.investopedia.com/mortgage-rates-hold-in-lower-ground-for-a-fifth-week-11737879

- https://finance.yahoo.com/news/mortgage-rates-drop-for-fifth-straight-week-160544782.html

- https://themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional

- https://www.investopedia.com/mortgage-rates-drop-for-three-straight-days-falling-to-lowest-level-since-early-april-june-26-2025-11761787

Comments

Post a Comment