Key Takeaways

- Nvidia's AI dominance: Maintains ~80% market share in data center GPUs, with Blackwell chips driving 40x performance gains .

- Bullish price targets: Analysts project $175-$250/share, with Loop Capital's $250 target implying 57% upside .

- Financial strength: Record $44.1B Q1 revenue (69% YoY growth), $39.1B from data centers alone .

- China risks: Export restrictions caused $5.5B charge, could impact $9B annual revenue .

- Long-term outlook: Data center spending projected to hit $1T by 2028, potentially doubling Nvidia's revenue .

The AI Juggernaut: Nvidia's Market Position

Right now, Nvidia ain't just leading the AI chip race—they're basically lapping the competition. With something like 80% market share in data center GPUs, they've become the go-to for anyone serious bout AI infrastructure . Their secret sauce? It's that tight integration between their custom CUDA software and hardware, creating a ecosystem thats incredibly sticky for developers. Once you're locked into their platform, switching costs become prohibitive.

What really stands out is how they've capitalized on this AI explosion. Last quarter alone, their data center revenue hit $39.1 billion—that's not just growth, thats explosive expansion . And CEO Jensen Huang keeps pointing to this massive $400 billion data center spending in 2024, with projections seeing it balloon to $1 trillion by 2028 . If Nvidia maintains their current slice of that pie, we could be looking at revenue doubling or even tripling in coming years.

But it ain't all just data centers no more. Their automotive segment, while smaller, grew 103% year-over-year to $570 million through deals with Toyota and Aurora Innovation . This diversification matters alot as trade tensions flare up.

Wall Street's Take: The Bull vs. Bear Divide

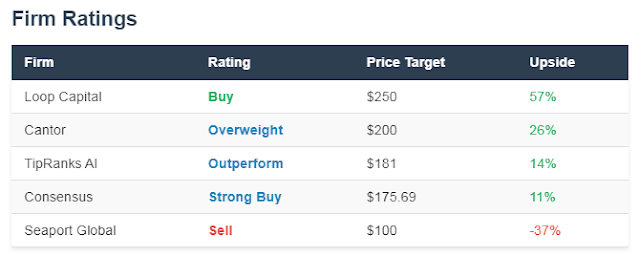

Analyst opinions on NVDA are all over the map, but the overwhelming sentiment leans bullish. TipRanks' AI analysis tool gives NVDA an "Outperform" rating with a $181 target, higher than Wall Street's $175.69 consensus . Then theres Loop Capital's wild $250 call—that'd mean 57% upside from current levels near $159 . Their argument? Unmatched leadership in AI chips and insane demand for Blackwell Ultra systems.

Table: Nvidia Analyst Price Target Spectrum

But lets not ignore the skeptics. Jay Goldberg at Seaport Global sticks out with his lone Sell rating and $100 target . His concern? That NVDA's current price already bakes in too much future growth, and that customers might tighten AI budgets by 2026 if ROI doesn't materialize. DA Davidson's also cautious, keeping a Neutral rating with $135 target citing regulatory risks and Huawei competition .

The stats tell the story tho: 58 of 66 analysts rate NVDA a Buy, with only one Sell . Even after the stocks monster run, most see room to run.

Financial Performance: Breaking Down the Numbers

Nvidia's Q1 2026 results were straight fire—$44.1 billion revenue, up 69% year-over-year despite taking a $700 million hit from China restrictions . Margins took a slight dip as Blackwell production ramped (73.5% vs 75% previous quarter), but CFO Colette Kress expects them to rebound to mid-70s once volumes stabilize .

Looking ahead, their Q2 guidance of $45 billion (±2%) already factors in an $8 billion revenue haircut from those pesky H20 chip bans . That forward visibility gives investors confidence management ain't just blowing smoke bout growth prospects.

Table: Nvidia's Financial Snapshot & Projections

What's really wild is their cash position—$37.6 billion sitting ready for R&D or strategic moves . And they're deploying it aggressively: Capex surged over 200% to $3.2 billion to meet hyperscaler demand, while R&D spend jumped 39% to $3.7 billion . That kinda investment suggests they're dead serious about maintaining their tech lead.

Blackwell: The Next Growth Engine

Nvidia's Blackwell platform isn't just an incremental upgrade—it's a paradigm shift. According to Cantor analyst C.J. Muse, Blackwell delivers about 40x better inference performance versus the previous Hopper chips . That's game-changing for AI workloads, especially as inference (using AI models) becomes more computationally intense than training them.

The product roadmap looks equally impressive:

- Blackwell Ultra: Launching 2H 2025

- Rubin: Expected 2H 2026

- Rubin Ultra: Slated for 2H 2027

Early orders are pouring in too. Amazon, Microsoft, Meta, and Oracle have already committed, and that Saudi deal for 18,000 GB300 Blackwell chips signals global demand . Each chip reportedly sells for 30-40% more than Hopper equivalents, which should juice both revenue and margins .

Muse nailed it when he said Nvidia's focus on integrating "best-in-class hardware with software initiatives" like their new Dynamo stack creates an ecosystem moat . This ain't just about chips anymore—it's about building full-stack "AI factories" that customers rely on end-to-end.

The China Conundrum: Risks and Workarounds

Let's be real—China's the biggest wildcard for Nvidia right now. Those U.S. export bans blocked sales of advanced chips like H100/H200, potentially costing $8-9 billion in annual revenue . The $5.5 billion charge they took for H20 chips (designed specifically to skirt restrictions) shows how serious this is .

Nvidia's response? Developing "Blackwell Lite" variants for the Chinese market . But even that faces hurdles:

- A congressional probe into alleged chip smuggling through third parties

- Huawei's Ascend chips gaining traction locally

- 10-15% price hikes on GPUs to offset tariff costs

The geopolitical tightrope walk continues. While Trump's tariff pause provided short-term relief , the structural risks remain. If tensions escalate, Piper Sandler's worst-case $77 valuation could come into play . Still, their diversification into automotive and regional partnerships (like Saudi Arabia's 500-megawatt data center project) helps hedge this exposure .

Competitive Landscape: Threats on the Horizon

Nvidia's dominance isn't uncontested. The competitive field's heating up:

- AMD's MI300X: Cheaper alternative gaining some cloud provider traction

- Huawei Ascend: Major threat in China with accelerated R&D

- Custom Silicon: Google, Amazon, Microsoft developing in-house AI chips to reduce reliance

Table: Nvidia Competitor Assessment

Despite these challengers, Nvidia's moat remains deep. Their software stack (CUDA, Omniverse, etc.) creates switching costs that hardware alone can't overcome . And with hyperscalers planning to spend $320 billion on AI/data centers in 2025 (up 39% YoY) , there's enough pie for multiple players to eat—even if Nvidia keeps the biggest slice.

Valuation: Pricey But Supported?

Trading around 30x forward earnings , NVDA isn't cheap—but context matters. With analysts expecting 50% EPS growth in 2026, its forward PEG ratio sits at 0.6x , suggesting it could actually be undervalued relative to growth potential.

Compare that to historical levels:

- Current P/E: ~30x forward earnings

- 3-year average P/E: ~65x

- Price/Sales: 28x (vs. AMD at 9x, Intel at 3x)

The bears ain't wrong bout valuation concerns, specially if growth slows faster than expected. But as long as Nvidia hits their $170 billion revenue target for 2026 (30% YoY growth from 2025's $130.5B) , that premium could stay justified.

What's interesting is TipRanks' AI analysis acknowledging "short-term concerns around technical overbought signals and valuation" while still recommending Outperform . That captures the dichotomy perfectly—yes, it's expensive, but fundamentals might support it.

Long-Term Outlook: The $1 Trillion Data Center Bet

Peering past 2025, the case for Nvidia hinges on data centers becoming a $1 trillion market by 2028 . If they maintain their current revenue share (~29% of the $400B 2024 spend), that implies $290B annual revenue—more than double today's run rate .

Their expansion into new domains adds optionality:

- Automotive: Self-driving partnerships with Toyota and Aurora

- Robotics: Isaac GR00T N1 foundation model for humanoid robots

- Healthcare: Collaborations with Novo Nordisk and GE HealthCare

Risks? Absolutely. Trade wars, hyperscaler capex cuts, or software ecosystem erosion could derail growth. But with $37.6 billion cash reserves and R&D spending up 39% , they're arming themselves for multiple futures.

For investors, the calculus boils down to belief in AI's longevity. As Huang framed it at GTC, we're entering the "age of AI reasoning" —and Nvidia's building the infrastructure underpinning it all. If that vision holds, even today's prices might look cheap in hindsight.

FAQ: Nvidia Stock (NVDA)

What's the 12-month price target for NVDA stock?

Analysts' average target is $175.69 (11.7% upside), with bullish calls up to $250 (57% upside) and bearish targets as low as $100 .

Can Nvidia stock reach $250?

Possible if Blackwell demand explodes, China restrictions ease, and AI adoption accelerates. Loop Capital sees this path by late 2025/early 2026 .

What are the biggest risks to Nvidia?

China export bans ($9B revenue impact), custom chip competition from hyperscalers, valuation sensitivity, and slowing AI ROI causing budget cuts .

How has Nvidia performed financially?

Q1 FY2026 revenue hit $44.1B (+69% YoY), with data centers contributing $39.1B. Guides Q2 revenue to $45B (±2%) despite $8B China headwinds .

Is Nvidia diversifying beyond AI chips?

Yes—automotive revenue grew 103% to $570M (Toyota/Aurora deals), with robotics, healthcare, and retail partnerships expanding .

What makes Blackwell chips special?

40x better AI inference performance vs. Hopper chips, 30-40% higher ASPs, and tight integration with Dynamo software for "AI factories" .

Should I buy NVDA stock now?

Depends on your risk tolerance. Bulls see 50%+ upside if AI growth continues; bears warn of overvaluation. Most analysts rate it Strong Buy .

Citing My Link Sources:

- https://economictimes.indiatimes.com/news/international/us/nvidia-stock-price-prediction-2025-can-nvda-hit-250-after-39-rally-or-will-china-trade-bans-and-ai-chip-rivals-trigger-a-pullback/articleshow/122207809.cms?from=mdr

- https://www.theglobeandmail.com/investing/markets/stocks/NVDA/pressreleases/31511165/200-is-in-sight-top-analyst-sees-70-upside-for-nvidia-stock/

- https://www.tipranks.com/stocks/nvda/forecast

- https://247wallst.com/investing/2025/07/02/nvidia-nasdaq-nvda-stock-price-prediction-for-2025-where-will-it-be-in-1-year/

Comments

Post a Comment