Key Takeaways

- Arbitrage betting exploits price differences across sportsbooks to guarantee profits

- Requires significant starting capital ($20k+ in examples) and specialized tools like OddsJam

- Sportsbooks actively detect and restrict arbitrage bettors through algorithms

- "Risk-free" bets actually provide bonus credits with strict wagering requirements

- Tax obligations (around 20%) significantly impact net profitability

The $3,000 Monthly Grind: Inside Real Arbitrage Betting

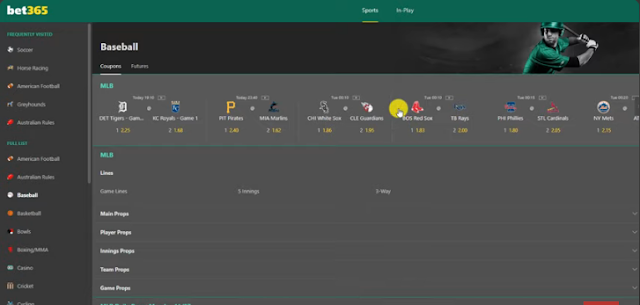

James Crosby’s story ain’t unique but it’s revealing - this Deloitte consultant pulls in about $3k monthly betting just 2 hours daily. How? Arbitrage betting. His method’s dead simple: exploit conflicting odds across sportsbooks like FanDuel and DraftKings . Like when he bet both sides of Alex Ovechkin’s shot count - over 3.5 on one site, under 3.5 on another. Total wager: $230. Guaranteed return: $249-250. That’s a free $19-20 risk-free .

But here’s what “arb consultants” won’t stress enough: you need serious startup cash. Crosby operates with $20,000 capital. Why? ‘Cause each arb yields just 3-4% profit. Bet $1,000? Make $30-40. Bet $100? Pocket just $3-4 . Those flashy income claims depend entirely on your bankroll size.

“I lasted around two weeks on most sportsbooks before they restricted me” - James Crosby

Sportsbooks hate arbers. They deploy algorithms to detect betting patterns - like consistent opposite bets across outcomes. Crosby got busted in days on some platforms. His workaround? Avoid obscure markets (Estonian basketball?) and stick to mainstream events to fly under radar longer .

Risk-Free Bets: The Misleading Hook

Let’s clear this up: “risk-free” bets disappeared after regulators cracked down. What you see now are “no sweat bets” or “first bet offers” - same product, rebranded . And they’re never truly risk-free.

Here’s how they actually work:

- You bet $500 on Team A at +200

- If you lose, get $500 bonus credits (not cash)

- Use credits on another bet

- If that wins, you get winnings MINUS original stake

See the trap? Say you use a $500 bonus bet on a -200 favorite:

- Win $250 on the bonus bet

- But you lost original $500 stake

- Net loss = $250

Table: Profit/Loss Scenarios on $500 “Risk-Free” Bet After Losing First Wager

Only odds of +100 or higher prevent losses . “Risk-free” offers work best when paired with matched betting - hedging the bonus bet against an exchange to lock profit .

Sportsbooks vs Arbers: The Detection Arms Race

Bookmakers deploy AI-powered algorithms to spot arbers. Red flags include:

- Betting identical amounts on opposing outcomes

- Consistently small profits

- Withdrawing funds immediately after winning

- Betting on obscure markets unusually

Once flagged, consequences escalate:

- Stake limits (capped at $10/bet)

- Account restrictions (can’t bet certain markets)

- Complete bans

Savvy arbers adapt with detection-avoidance tactics:

- Round bets to $100 instead of $98.73

- Place occasional recreational bets

- Withdraw irregularly, not after every win

- Avoid betting both sides at same bookie (instant red flag)

Bookmakers tolerate some arbing though - it helps them identify odds-setting errors. As Crosby notes, arbers act like free consultants showing where odds are exploitable .

Tax Talk: The $8,500 Reality Check

Crosby’s on track for $8,500 in three months - sounds sweet right? But he immediately budgets 20% for taxes . This gets overlooked in “risk-free” claims.

Sports betting profits are taxable income. In the US:

- Profits reported as “other income” on IRS Form 1040

- No loss deductions unless you itemize

- State taxes vary (e.g., 8.82% in NY)

“I put my tax portion in low-risk stocks so I don’t lose it” - Crosby’s approach

Unlike stocks, you can’t offset losing bets against wins unless you’re a professional gambler (requires IRS qualification). Casual bettors pay taxes on every winning ticket, not net annual profits .

Arbitrage Tools: Odds Scanners vs. Bots

You need tech to find arbs fast. Two approaches dominate:

1. Odds Scanners (e.g., OddsJam)

- Scans 12+ sportsbooks in real-time

- Identifies mispriced odds across platforms

- Costs $200+/month but Crosby says “pays for itself quickly”

2. Automated Bots (e.g., BetOven)

- Places bets automatically when arbs appear

- Claims “100% automation”

- Catches arbs lasting milliseconds

Table: Manual vs Automated Arbitrage Approaches

|

Bots aren’t illegal but sportsbooks ban them instantly. Success requires multiple accounts spread across devices/IP addresses .

The Scalability Problem Nobody Mentions

Arbitrage has hard scalability limits:

- Limited opportunity windows: Arbs last minutes (sometimes seconds)

- Account restrictions: More profit = faster bans

- Capital requirements: Making $10k/month requires ~$300k bankroll at 3-4% ROI

Crosby’s roommate makes “$30-40k yearly” - solid side income but not life-changing. And that’s after years building:

- 12+ sportsbook accounts

- OddsJam subscription ($2,400/year)

- $20k+ always deployed across books

Regional differences matter too:

- US-focused arbs: Lower margins (1-3%) but more sportsbooks

- International arbs: Higher margins (5-10%) but complex currency/withdrawal issues

Legality vs. Practicality: The Arb Consultant’s Lie

Arbitrage betting is 100% legal where sports betting is regulated. But legal ≠ feasible long-term.

“Arbitrage consultants” sell courses implying anyone can profit. They omit:

- Geolocation tracking: Need accounts in multiple states

- KYC verification: Can’t fake identities legally

- Betting limits: Books slash max stakes for winners

- Tax complexity: 30+ state tax regimes

True profitability requires treating it like a business:

- Separate bank accounts for betting funds

- Detailed profit/loss tracking

- Quarterly estimated tax payments

- Legal entity formation (LLC/S-Corp)

FAQ: Arbitrage Betting Realities

Q: Can I start arbitrage betting with $500?

A: Technically yes, but expect ~$15-20 profit per arb. With 1-2 arbs daily, that’s $450-600/month before taxes/subscription costs .

Q: Do sportsbooks sue arbitrage bettors?

A: No. Worst case is account closure with balance returned (unless terms violation) .

Q: Which sports are best for arbing?

A: Tennis (2 outcomes), basketball (point spreads), soccer (3-way markets with draw) .

Q: How long until sportsbooks restrict you?

A: 3 days to 3 weeks typically. Using 12+ accounts spreads the risk .

Q: Are “arbitrage consultants” worth hiring?

A: Questionable. Free resources like OddsJam tutorials cover basics. Advanced tactics require personal experience with your specific bankroll and location .

Citing My Link Sources:

- https://www.businessinsider.com/sports-betting-arbitrage-easy-low-risk-strategy-side-hustle-2025-5

- https://arbbets.medium.com/maximizing-profits-with-arbitrage-sports-betting-a-beginners-guide-a6f1d43cbbcb

- https://sdlccorp.com/post/how-to-recognize-and-use-arbitrage-opportunities-in-sports-betting/

- https://www.footboom1.com/en/news/football/2444649-understanding-risk-free-bets-your-comprehensive-guide

- https://www.sportsbettingdime.com/guides/bonuses/risk-free-bet-offers/

- https://matchedbettingblog.com/risk-free-bet-offers/

- https://www.idenfy.com/blog/arbitrage-sports-betting/

- https://oddsjam.com/betting-tools/arbitrage

Comments

Post a Comment