Key Takeaways

- Global markets showed surprising calm after Trump's new tariffs, with Asian and European stocks rising despite threats .

- Investors revived the "TACO theory" (Trump Always Chickens Out), betting tariffs won’t stick due to negotiation flexibility .

- Corporate earnings reports (starting July 15) will reveal real tariff impacts—profit margins face pressure if costs aren’t passed to consumers .

- The EU and India avoided immediate tariffs, signaling potential deals that eased investor nerves .

- Long-term risks remain as August 1 deadlines and debt ceiling talks could reignite volatility .

Markets’ Muted Monday: Why Panic Didn’t Stick

So Wall Street did dip when Trump dropped them tariff letters on Monday—Dow down 422 points, S&P off 0.8%, tech stocks dragging Nasdaq lower too . Auto stocks like Toyota and Honda got hit hardest, falling 4% and 3.9% as traders priced in the 25% duties on Japanese cars . South Korean tech firms like LG Display tanked 8.3%, which ain't small change . You’d think that’d set off fireworks, right? But here’s the weird part: by Tuesday morning, Asia’s markets was already climbing. Nikkei up 0.3%, Kospi surging 1.8%, Hang Seng rising 1.1% . Like they barely flinched.

Why the calm? Two things. First, Trump himself called the August 1 deadline “firm, but not 100% firm” . That’s classic Trump—leaving himself wiggle room. Second, the 90-day negotiation window ending July 9 got pushed to August, giving everyone breathing space . Investors seen that delay as proof talks would keep going. As ING’s Chris Turner put it, markets reacted “in sanguine fashion” since more deals seemed likely before August .

Table: Initial Market Reactions to Trump’s Tariff Letters

The “TACO Trade” Is Back: Why Traders Bet Against Trump

Alright, let’s talk TACO. No, not the snack—the “Trump Always Chickens Out” trade . It’s back in fashion on trading floors. See, back in April when tariffs first got floated, markets freaked out. Global sell-offs, volatility spiking—real chaos. But this time? Nada. AJ Bell’s Dan Coatsworth nailed it: investors think Trump’s bluffing again . They’re counting on him backing down if countries just pick up the phone.

And honestly, there’s evidence. Take Vietnam. Trump threatened 46% tariffs in April, but the final deal signed last week capped ’em at 20% . That’s a huge climbdown! Plus, Treasury Sec Scott Bessent teased “several announcements in the next 48 hours” after the letters went out . Traders took that as a signal: these tariffs ain’t set in stone.

But here’s where it gets tricky. Smaller countries like Laos or Myanmar—facing 40% duties—might not have the leverage to negotiate . Lawrence Loh from National Uni of Singapore says they’ll likely swallow the tariffs ’cause “retaliation is out of the question” . So while Japan or the EU can play hardball, emerging economies got less room to breathe.

Who Got Hit? Breaking Down the Tariff Rates

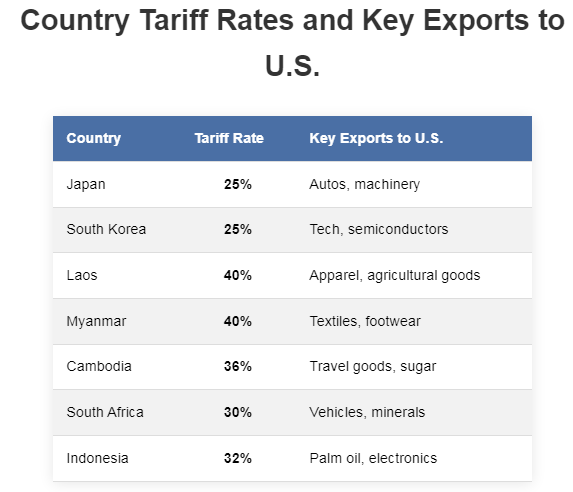

Trump’s letters targeted 14 countries, but the rates was all over the place . Japan and South Korea—big U.S. allies—got “only” 25%. Laos and Myanmar got slammed with 40%. Why the spread? Two reasons: trade deficits and geopolitics.

Table: Trump’s Tariff Rates by Country (Effective August 1)

South Korea’s trade ministry called for “mutually beneficial” talks fast , while Japan’s PM Ishiba labeled the move “truly regrettable” . But notice who wasn’t on the list: the EU, India, Taiwan . That’s huge. An EU diplomat told CNBC a deal might be close, maybe with a 10% baseline tariff and exemptions for planes or whiskey . If that holds, it’s a major reason stocks stayed calm.

Why Europe’s Stocks Barely Budged

Europe’s markets was flat Tuesday—Stoxx 600 down just 0.09% . Why no panic? ’Cause they think a deal’s coming. Ursula von der Leyen (EU Commission prez) had a “good exchange” with Trump over the weekend , and leaks suggest the EU might get a letter later this week . That delay’s read as extra negotiation time.

Kiran Ganesh at UBS pointed out the obvious: no EU letter means talks are progressing . Markets now expect final tariffs to settle near 15%—the current effective rate—but with tweaks. Like, lower country-wide tariffs but higher duties on specific sectors like semiconductors or pharma . That’s manageable for big firms. Still, Toni Meadows at BRI Wealth warned investors might be too relaxed. Real trade deals take “months, even years,” not 90 days . And if talks drag into August, they’ll clash with U.S. debt ceiling drama—another volatility trigger.

Earnings Season: Where Tariffs Really Bite

Here’s what nobody’s talking about yet: Q2 earnings start July 15 . That’s when we’ll see tariffs’ real damage. Goldman Sachs’ David Kostin says clients are obsessed with one question: who’s eating the cost? Companies can either:

- Pass 70% to consumers (raising prices)

- Or slash profit margins to absorb it

So far, consumer prices only crept up mildly. But earnings growth is projected to slow to 4% this quarter—down from 12% in Q1 . And margins? Likely squeezed by 0.5%. Firms with big pre-tariff inventories (like some retailers) might dodge the bullet short-term. But autos, tech, and industrials? They’re exposed.

Projected S&P 500 Margin Contraction (Q2 2025)

The Dollar’s Surge and Emerging Market Risks

While stocks yawned, currencies didn’t. The dollar jumped 1.1% against the yen, hitting ¥146.13—a one-week high . Why? ’Cause tariffs make imports costlier, fueling inflation. And when inflation looms, the Fed hesitates to cut rates. Higher rates = stronger dollar.

For emerging markets, that’s a double whammy. Take Indonesia or Bangladesh—facing 32-35% tariffs . Their currencies are already weakening, making dollar-denominated debt pricier to repay. Calvin Cheng (economist in Kuala Lumpur) thinks smaller nations will “deploy every lever” to negotiate but warns tariffs might stay high . If so, countries reliant on U.S. exports—like Cambodia’s garment industry—face job losses or factory shutdowns.

Historical Precedent: How 2025 Differs From 2018

Old-timers remember Trump’s 2018 tariffs. Back then, markets tanked for weeks. Why’s 2025 different? Three reasons:

- Positioning: Investors entered 2018 unprepared. Now, tariffs are priced in.

- Policy Recycling: The “Megabill” passed by Congress funnels tariff revenue back into tax cuts, softening the economic blow .

- Deals: China, UK, and Vietnam already reached agreements, proving compromise is possible .

Still, Paul Ashworth at Capital Economics flags a risk: if no more deals happen, average U.S. tariffs could hit 17.3%—up from 2.5% in 2024 . That’s uncharted territory.

What’s Next: August Landmines and Investor Fatigue

August 1 ain’t the only deadline. The U.S. debt ceiling talks resurface mid-month , and if tariffs coincide with a fiscal standoff? “Markets won’t stay this sanguine,” warns BRI Wealth’s Toni Meadows .

Plus, the “TACO trade” could backfire. If Trump doesn’t fold—say, with Laos or Tunisia—it proves he’s serious. Wells Fargo’s Scott Wren thinks consensus is “overly optimistic,” noting consumer spending could crater as tariffs bite .

Bottom line: stocks called Trump’s bluff for now. But with earnings, negotiations, and debt fights converging, July’s calm might break.

FAQ: Trump Tariffs and Market Impact

Q: Which countries face new tariffs?

A: Japan (25%), South Korea (25%), Laos (40%), Myanmar (40%), Cambodia (36%), South Africa (30%), Indonesia (32%), and 7 others .

Q: Did the EU get tariff letters?

A: Not yet. An EU diplomat expects one later this week, but delays signal ongoing talks .

Q: Why didn’t stocks crash?

A: Investors bet Trump will soften tariffs (the “TACO theory”) and expect deals before August .

Q: How high could U.S. tariffs go overall?

A: If no deals happen, the average rate may hit 17.3%—up from 15.5% now .

Q: When will we see tariff damage in earnings?

A: Q2 reports (from July 15) may show margin squeezes, especially in autos and tech .

Comments

Post a Comment