U.S. Copper Prices Hit Record 138% Premium: Tariff Spike to Fuel Inflation, Manufacturing Costs & Economic Risks | July 2025

Key Takeaways

- Historic price gap: US copper prices hit record highs, trading at a 138% premium after Trump's 50% tariff announcement .

- Supply chain chaos: Traders rushed copper into US ports since February, anticipating tariffs – inventories now overflow but future shortages loom .

- Economic shockwaves: Every American-made product using copper – from air conditioners to EVs – faces imminent price hikes .

- Renewable roadblock: US electrification goals (EVs, grid upgrades, solar farms) now cost significantly more, risking climate targets .

- Global fallout: Chile, Canada, and Mexico scramble to renegotiate deals as their US-bound copper shipments face collapse .

Why Copper Prices Exploded Overnight

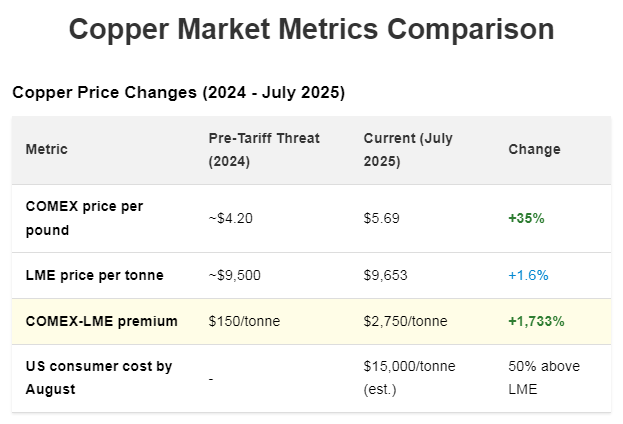

So Tuesday July 8th, Trump drops the bomb during a cabinet meeting: "Today we’re doing copper" – straight up 50% tariffs on imports. Markets went nuts. Comex copper futures shot up 17% in hours, hitting $5.69/lb ($12,500+/ton). That’s the craziest single-day jump since 1989 . Meanwhile in London? Barely budged – just 0.3% up .

See, this premium ain’t normal. For years US and global copper prices moved together, like within $150/ton difference. But since February when Trump whispered "tariffs", that gap blew out to $1,500. Now? Try $2,750/ton . Traders been front-running this for months – shoving metal into US warehouses like there’s no tomorrow. But once tariffs hit August 1st? That flow stops dead .

Table: US vs Global Copper Price Divergence

Sources:

How Global Copper Trade Just Broke

America imports nearly half its copper – about 700,000 tons yearly. Chile’s the big dog (38%), then Canada (28%), Mexico (8%) . Now imagine you’re Codelco, Chile’s state miner. Overnight, 350,000 tons of your US-bound copper just got 50% more expensive. Buyers ain’t swallowing that. So either they eat the cost, switch suppliers, or ditch copper entirely for aluminum .

Europe’s sweating too. German Chancellor Merz rushed to say he’s "cautiously optimistic" about a tariff deal within days . But here’s the kicker: even if Europe negotiates lower rates, supply chains already snapped. Ships en route to Houston? Diverting to Rotterdam. Contracts signed months ago? Cancelled. This ain’t just prices – it’s logistics chaos .

And domestic production? Not happening overnight. Opening new US mines takes 10-16 years with permitting hell . America’s got just two smelters operating. No way they fill the gap .

Where You’ll Feel This: Everyday Costs

Okay, real talk – how’s this hit your wallet? Copper’s everywhere:

- Your AC unit: Contains 50+ lbs of copper. Price could jump $200+

- New cars: Average gas car uses 50 lbs; EVs use 180 lbs. That’s $1,000+ cost add for EVs

- Homes: Wiring a new house needs 400+ lbs copper. Say hello to $5k+ extra construction costs

- Infrastructure: Biden’s lead pipe replacement plan? Relies on copper pipes. Project delays incoming

Daan de Jonge from Benchmark Minerals put it bluntly: "Companies could reasonably be expected to pass that on" . Worse yet, US manufacturers might get undercut by imports. Why buy a $1,200 US-made fridge when a German model’s $950? Tariffs should help US factories, but could backfire if consumers import finished goods .

Green Energy’s New Copper Crisis

This hurts where it really matters: America’s energy transition. Copper’s the bloodstream of electrification:

- EV chargers: 10+ lbs per station

- Solar farms: 5+ tons per megawatt

- Grid upgrades: Millions of lbs needed nationwide

S&P Global projected US copper demand to double by 2035 even before the AI boom . Now with data centers gulping power? We need more copper, not less. But at $15,000/ton versus global $10,000? Solar developers might delay projects. EV makers could use less copper per battery – sacrificing range. Or swap to aluminum, which corrodes faster and hikes maintenance .

Renewable Projects at Risk from Copper Costs

Trade Wars and Broken Deals

Trump’s playing hardball beyond copper. Pharma tariffs (200%!) and chips are next . But here’s the weird part: the 50% rate shocked everyone. Traders expected 25-30% . Why so high? Probably negotiation tactics.

Canada’s freaking out. They supply 28% of US copper imports – mostly through integrated mines like Quebec’s Horne smelter . If tariffs hit, those shipments stop. But building new US-Canada supply chains? Takes years. Meanwhile, China’s circling Chile and Peru offering premium prices. US could lose key suppliers permanently .

What Comes Next: Short-Term Pain vs Long-Term... Pain

Next 3 months: Pure chaos.

- Tariffs likely hit August 1

- US premiums stay extreme as inventories dwindle

- Consumer goods prices jump by September

6-12 months out:

- Domestic mining? Not happening. Permitting takes 16+ years

- Substitution accelerates (aluminum in wiring, pipes)

- Some tariff exemptions negotiated (Canada likely first)

Long-term reality: Even if tariffs vanish tomorrow, trust in US trade stability is shot. Global firms won’t risk relying on US buyers. Copper’s future is regional hubs now – Americas, Europe, Asia. Less efficiency, more costs for everyone .

FAQs: Your Copper Tariff Questions

Q: When do copper tariffs actually start?

A: Commerce Secretary Lutnick says "end of July, maybe August 1." No formal order yet though .

Q: Will this make my electronics more expensive?

A: Yes, but gradually. New iPhones or laptops won’t spike overnight, but products with heavy copper wiring (appliances, cars) will rise faster .

Q: Can the US produce enough copper domestically?

A: Not even close. We’d need to double mining output overnight. Current mines operate near capacity, and new ones take 10-20 years to open .

Q: Who benefits from these tariffs?

A: Short-term? Traders who stockpiled copper pre-tariff. Long-term? Maybe US miners – if they can raise billions to expand, and if prices stay high for years .

Q: Could this trigger a recession?

A: Analysts warn of "demand destruction" – where high prices kill consumption. If automakers slash production or renewables stall, job losses could follow .

This ain’t just about metal. It’s about whether America can build its electric future when the wiring costs 50% more here than anywhere else.

Comments

Post a Comment