Key Takeaways

- Vertiv stock dropped 6-11% after AWS announced its custom liquid cooling system for NVIDIA Blackwell chips, sparking fears of lost market share .

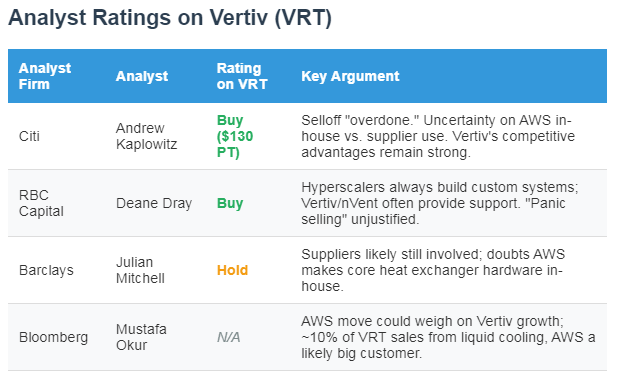

- Analysts from Citi, RBC Capital, and Barclays largely called the selloff "overdone," emphasizing Vertiv's intact competitive advantages and AWS's likely reliance on suppliers .

- Liquid cooling represents ~10% of Vertiv’s sales, with AWS potentially being a major customer; the overall market is projected to grow from 15% to 30% of thermal management by 2027 .

- Conflicting reports emerged: Some sources framed AWS as a competitor, while Finimize highlighted a partnership for "integrated liquid cooling solutions" .

- Vertiv maintains a Strong Buy consensus (13 Buys, 2 Holds) with a $125.27 average price target (~4% upside), suggesting analysts see the dip as temporary .

Vertiv Stock Tumbles: AWS Drops a Custom Cooling Bombshell

Investors didn't waste no time reacting to Amazon's news. On July 10th, 2025, shares of Vertiv (VRT) plummeted as much as 11% before settling around a 6-7% loss for the day . The trigger? Amazon Web Services (AWS) unveiled its homegrown In-Row Heat Exchanger (IRHX) cooling system. Designed specifically for NVIDIA's powerhouse Grace Blackwell Superchips, this tech tackles the massive heat generated by these AI-workload beasts . AWS VP Dave Brown bluntly stated existing solutions from vendors "would take up too much data center floor space or increase water usage substantially." Ouch. That stung Vertiv investors, who saw AWS not just as a potential customer, but now a direct competitor in the critical liquid cooling space .

The speed of AWS's move was startling – they developed the IRHX in just 11 months alongside NVIDIA . This hybrid system uses liquid-cooled cold plates directly on the GPU chips, paired with air-cooled fan-coil arrays, aiming for high efficiency without major data center retrofits . For Vertiv, whose CoolPhase Flex platform targets this exact market, the announcement felt like a gut punch. Bloomberg Intelligence analyst Mustafa Okur quickly pointed out the risk: "Around 10% of overall sales come from liquid cooling, we calculate, and AWS may be one of the largest customers" . Suddenly, Vertiv wasn't just facing competition; it seemed they might lose a key client to that competition.

Analyst Uproar: Why the Panic Might Be Premature

The Wall Street analyst chorus responded fast, and their main tune was: "Whoa, this selloff is way overdone!" Citi's top analyst Andrew Kaplowitz led the charge, calling the drop excessive. He hammered home a crucial uncertainty: It’s totally unclear how much of this tech AWS is actually building in-house versus sourcing from suppliers like Vertiv or nVent Electric (NVT) . Kaplowitz kept his Buy rating and $130 target firmly in place, stressing Vertiv’s "market-leading portfolio" and deep ties with chipmakers like NVIDIA as solid defenses .

RBC Capital's Deane Dray echoed this, dismissing fears of Vertiv being "disintermediated" (fancy Wall Street talk for 'cut out'). He noted this wasn’t even fresh news – AWS had hinted at this system weeks prior on June 11th. More importantly, Dray highlighted a critical industry dynamic: Big cloud players like AWS routinely cook up custom next-gen systems. But they don’t do it all alone. Companies like nVent and Vertiv? They’re often the ones providing essential "development and test support" behind the scenes . Barclays’ Julian Mitchell added another layer, doubting AWS would bother making the core "in-row heat exchanger hardware" itself .

Table: Analyst Reactions to AWS Cooling Announcement & Vertiv Impact

Liquid Cooling: The High-Stakes Game Behind the Stock Swing

So why’s everyone so worked up about liquid cooling? It’s simple: AI chips like NVIDIA’s Blackwell are power hogs, generating insane heat. Traditional air cooling just can’t keep up efficiently in dense server racks . Liquid cooling – circulating coolant directly to hot spots – is way more effective, making it essential for the AI data center boom. Vertiv itself projects this segment will explode, growing from roughly 15% of the thermal management market today to 30% by 2027 . That’s a massive growth runway. Losing share here, especially to a giant like AWS, would hurt Vertiv’s future.

AWS’s IRHX approach is interesting cause it tries to solve a real pain point. Brown said building fully liquid-cooled data centers from scratch was too slow, especially with Blackwell chips arriving fast. Existing vendor solutions, while good, apparently "didn’t scale" for AWS’s specific needs – too bulky or too thirsty for water . Their hybrid liquid-air solution aims for a quicker deployment without massive renovations. But does this mean Vertiv’s tech is obsolete? Unlikely. Kaplowitz emphasized Vertiv’s "strong relationships with chip manufacturers" and leadership in power and thermal management as key strengths . The liquid cooling market is still young and fragmented ("highly fluid," as Kaplowitz put it), meaning multiple players and approaches can thrive, especially one as entrenched as Vertiv .

Contradictory Signals: Competition or Collaboration?

Here’s where things get messy. While most reports screamed "Competition!", one source, Finimize, threw in a curveball. They claimed Vertiv is actually "partnering with Amazon to create integrated liquid cooling solutions for AI servers," focusing on boosting efficiency together, not competing head-on . UBS apparently backed this view, keeping a Buy rating on Vertiv with a $135 target. They argued the manufacturing complexity makes it unlikely Amazon would become a full-fledged competitor, preferring to lean on Vertiv’s expertise .

So which is it? Both narratives hold some truth. Hyperscalers like AWS do develop custom kit for their unique needs. They also rely heavily on established suppliers for components and expertise. An AWS custom system doesn’t automatically erase Vertiv’s role. As Citi pointed out, Vertiv’s global service network and broad portfolio across power and cooling remain huge assets . They’re not just a box seller; they provide integrated infrastructure solutions. A custom AWS rack might still use Vertiv components or services somewhere in the stack, or Vertiv might support its deployment. The partnership angle suggests collaboration might coexist with areas of competition.

Vertiv’s Path Forward: Resilience Amidst the AI Gold Rush

Looking past the noise, Vertiv’s core growth story still looks pretty solid. Remember their killer Q1 results? 25% organic sales growth . The demand for data center infrastructure, driven by AI and cloud expansion, isn’t vanishing because AWS built one custom system. Citi highlighted "strong prior orders" ensuring solid near-term visibility for Vertiv . Their position as a one-stop shop for critical power and cooling needs in data centers remains formidable.

The analyst consensus reflects this underlying strength. Despite the stock wobble, Vertiv holds a Strong Buy rating based on 13 Buys versus just 2 Holds. The average price target sits at $125.27, offering potential upside from recent levels . Kaplowitz’s view that the pullback is a "buying opportunity" hinges on Vertiv being a "primary beneficiary" of the liquid cooling market’s expected surge to 30% penetration by 2027 .

Table: Vertiv Financial Snapshot & Market Position

Investor Takeaway: Navigating the Cooling Conundrum

The Vertiv selloff sparked by AWS’s cooling tech is a classic case of market jitters meeting a complex reality. Sure, AWS developing custom solutions is a competitive consideration. Vertiv isn’t immune. The 10% exposure to liquid cooling means shifts in that market matter . However, the analyst pushback is compelling. The panic seems disproportionate given:

- Unclear Competitive Impact: It’s not proven AWS is fully bypassing suppliers like Vertiv. Collaboration might still happen .

- Vertiv’s Strong Moat: Leadership in power and thermal, global scale, and chipmaker relationships are durable advantages .

- Massive Market Growth: The liquid cooling pie is growing fast enough for multiple players to succeed .

- Solid Near-Term Backlog: Existing orders provide earnings visibility cushion .

For investors, the dip might indeed be an opportunity, if you believe in the long-term AI data center build-out and Vertiv’s role within it. The stock’s wild run (up 10x since 2022!) made it vulnerable to profit-taking on any negative news . This AWS announcement provided the perfect excuse. While volatility might linger short-term, Vertiv’s fundamentals and growth trajectory, supported by strong analyst conviction, suggest resilience. Keeping an eye on how the AWS-Vertiv dynamic truly unfolds – pure competition or mixed collaboration – is key. But writing off Vertiv based on this single announcement looks premature. As Citi's Kaplowitz summed it up, the selloff just seems "overdone" .

Frequently Asked Questions

Why did Vertiv stock drop so sharply?

Vertiv stock fell 6-11% on July 10, 2025, after Amazon Web Services (AWS) announced its custom In-Row Heat Exchanger (IRHX) liquid cooling system for NVIDIA Blackwell AI chips. Investors feared AWS, a potential major Vertiv customer, was becoming a direct competitor, threatening Vertiv’s ~10% revenue stream from liquid cooling .

Are analysts still positive on Vertiv stock?

Yes, overwhelmingly. Major firms like Citi and RBC Capital called the selloff "overdone." They argue Vertiv’s competitive strengths (tech portfolio, chipmaker ties, global service) remain intact, and AWS likely still uses suppliers for components. Vertiv maintains a Strong Buy consensus rating (13 Buys, 2 Holds) with a $125.27 average price target .

Is AWS now a direct competitor to Vertiv in cooling?

It’s complex. AWS is developing custom cooling for its own data centers, which competes with Vertiv’s offerings. However, reports also suggest potential collaboration, with Finimize stating Vertiv is "partnering with Amazon for liquid cooling solutions." Analysts doubt AWS will manufacture all components itself, suggesting Vertiv could still supply parts or expertise .

How important is liquid cooling to Vertiv’s business?

Liquid cooling represents roughly 10% of Vertiv’s total sales, but it’s a critical high-growth segment. Vertiv projects the liquid cooling market will grow from ~15% to 30% of the data center thermal management market by 2027. Success here is vital for Vertiv’s long-term AI-driven growth story .

Should I consider buying Vertiv stock after the drop?

Many analysts, like Citi’s Andrew Kaplowitz, view the pullback as a "buying opportunity" based on Vertiv’s strong market position, growth prospects in power and cooling, and the expectation they remain a key beneficiary of the liquid cooling market expansion. However, expect continued volatility as the AWS competitive dynamic evolves .

Comments

Post a Comment