Key Takeaways

- 🚨 FDA Warning Issued: The FDA sent WHOOP a warning letter on July 14, 2025, declaring its Blood Pressure Insights (BPI) feature an unapproved medical device .

- ⚖️ Regulatory Dispute: WHOOP argues BPI is a wellness tool (exempt from FDA review), while the FDA insists blood pressure measurement is inherently clinical .

- 💡 How BPI Works: Uses morning heart rate, HRV, and blood flow patterns (calibrated via a cuff) to estimate daily systolic/diastolic ranges, not real-time readings .

- ⚠️ FDA’s Safety Concerns: Inaccurate readings could delay hypertension treatment, risking stroke or heart failure .

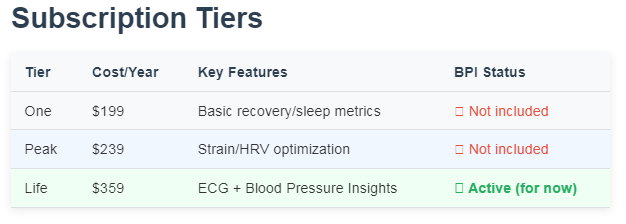

- 💰 Consumer Impact: BPI is a key selling point of WHOOP’s $359/year “Life” tier. Removal could devalue the subscription .

- ⏳ Current Status: BPI remains active in the U.S. as WHOOP contests the FDA’s stance .

The FDA-WHOOP Clash Over Blood Pressure Insights

What’s Happening?

On July 14, 2025, the FDA sent WHOOP a formal warning letter. The agency said WHOOP’s Blood Pressure Insights (BPI) feature is an unapproved medical device. The FDA told WHOOP to stop marketing BPI immediately. They said the feature violates U.S. law .

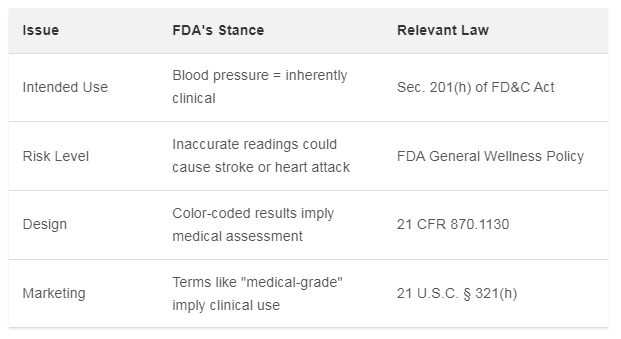

The FDA pointed to WHOOP’s own website. It showed descriptions like “daily systolic and diastolic blood pressure estimations” and “medical-grade health insights.” The agency said these phrases prove BPI is intended for medical use, not just wellness .

WHOOP got 15 business days to respond. If they ignore this, the FDA could take action. This includes fines, product seizures, or even court orders to stop sales .

Why the FDA Calls BPI a Medical Device

The FDA’s argument centers on intent. Under U.S. law, a product is a medical device if it diagnoses disease or affects bodily functions. Blood pressure measurement, the FDA says, is “inherently associated” with diagnosing hypertension .

Even though BPI only gives daily estimates (not real-time readings), the FDA says that doesn’t matter. The feature still outputs blood pressure numbers. It also color-codes results (green/yellow/orange) to indicate risk levels. This, the FDA says, could lead users to self-diagnose .

The agency also noted real-world evidence. Some users already treat BPI as a diagnostic tool. For example, tracking hypertension with it. Disclaimers don’t help, the FDA says. The design itself encourages medical use .

Table: FDA’s Key Arguments Against BPI

WHOOP’s Defense: Wellness, Not Medicine

WHOOP disagrees strongly. They say BPI is purely a wellness feature. It helps users see how lifestyle affects performance. Not diagnose disease .

In their public response, WHOOP compared BPI to other wellness metrics. Like heart rate variability (HRV) or respiratory rate. These don’t need FDA clearance. Blood pressure, they argue, should be treated the same .

They also stressed BPI’s design:

- Requires calibration with a traditional cuff.

- Only provides daily ranges (not on-demand checks).

- Focuses on trends, not absolute numbers .

“Blood pressure acts like a mirror,” WHOOP wrote. It reflects how your body handles stress, sleep, or exercise. That’s wellness, not medicine .

How Blood Pressure Insights Actually Works

BPI isn’t like a doctor’s blood pressure cuff. Here’s how it works:

- Calibration: Users take 3 readings with a standard cuff. This sets a baseline.

- Overnight Tracking: While you sleep, WHOOP’s sensor (on the MG device) measures heart rate, HRV, and blood flow patterns.

- Morning Estimate: You get a systolic/diastolic range and midpoint. Based on overnight data when the body is rested .

WHOOP trained the algorithm using 32,000 sleep sessions from 11,000+ members. They say it’s validated against clinical readings .

But accuracy isn’t the FDA’s main gripe. It’s about how the data could be used. Even precise numbers, the FDA says, belong under medical oversight .

Why Blood Pressure Is Different From Heart Rate

WHOOP asks: Why single out blood pressure? Why not heart rate or HRV?

The FDA gave a clear answer in its letter. Blood pressure is uniquely tied to disease. Hypertension is a top risk for heart attacks and strokes. Misleading readings could have dire consequences .

Dr. Ian Kronish (Columbia University Hypertension Center) explained the risk:

“If someone with hypertension gets falsely low readings, they might skip treatment. That could lead to organ damage or even death. Especially since hypertension often has no symptoms.”

Heart rate variability doesn’t carry the same risk. No one treats an HRV dip as a heart attack warning. Blood pressure? People do .

The Stakes for Consumers

If WHOOP loses this fight, users lose a feature they paid for. BPI is exclusive to the “Life” membership tier. That costs $359/year, $120 more than WHOOP’s mid-level plan .

Table: WHOOP Membership Tiers (U.S.)

Without BPI, the Life tier offers only ECG readings. That’s a common smartwatch feature. As one Redditor said:

“We paid for this. If it’s removed, we deserve compensation.”

Legal Context: The 21st Century Cures Act

WHOOP cites the 21st Century Cures Act to defend BPI. This law excludes some software from medical device rules. Especially tools that “maintain or encourage a healthy lifestyle” .

But the FDA says BPI doesn’t qualify. Why? Because it’s not “unrelated to disease.” Blood pressure is inherently clinical. The agency also notes BPI isn’t “low risk.” So it falls outside the exemption .

Past products got cleared as medical devices for similar functions. Like Omron or Garmin’s FDA-approved blood pressure monitors .

What Happens Next

Right now, BPI is still available. WHOOP hasn’t pulled the feature. They’re fighting the FDA’s interpretation .

Options for WHOOP:

- Comply: Remove BPI in the U.S. and refund users.

- Negotiate: Change how BPI works (e.g., remove color-coding).

- Fight: Argue in court that the FDA overstepped .

The outcome could reshape wearables. If the FDA wins, features like glucose or oxygen monitoring might face stricter rules. Even if marketed for wellness .

Expert Take: A “Big Opportunity” With Risks

Dr. Ian Kronish sees both sides. He told CNBC:

“Wearables present a big opportunity for patients. But unvalidated tools? Dangerous. The FDA’s involvement here is good for consumers.”

He urges users to talk to doctors. Don’t rely on wearables for medical decisions. Especially for blood pressure .

Frequently Asked Questions

Is WHOOP removing the blood pressure feature?

Not yet. As of July 16, 2025, Blood Pressure Insights remains active for U.S. members on the Life tier. WHOOP is contesting the FDA’s warning .

Can I trust WHOOP’s blood pressure readings?

WHOOP claims its model is validated against clinical data. But the FDA hasn’t verified its accuracy. For health decisions, use an FDA-cleared monitor like Omron .

Why did the FDA approve WHOOP’s ECG but not BPI?

ECGs got FDA clearance because WHOOP proved they detect atrial fibrillation, a specific condition. BPI estimates general blood pressure, which the FDA says is broadly clinical .

What should WHOOP Life members do now?

Keep calibrating BPI with a cuff. But discuss trends with a doctor. If WHOOP removes BPI, request a partial refund for the lost feature .

Are other wearables affected?

Samsung’s blood pressure tool isn’t available in the U.S. Apple hasn’t released one. Only FDA-cleared tools (like Omron HeartGuide) are legal here .

Comments

Post a Comment