Yield Curve Forecasting and Economic Analysis

Key Takeaways

- Yield curves normalized in early 2025 after prolonged inversion, with the 2s/10s spread turning positive at ~40 basis points .

- Term premiums surged to decade highs due to tariff uncertainty and deficit concerns, driving long-end volatility .

- Recession probability rose to 46% as growth forecasts were slashed (2025 GDP: 0.3% vs. prior 1.2%) .

- Vasicek and DSGE models outperformed surveys by incorporating real-time market data and tariff shocks .

- Tactical trades: Curve flatteners (short 2Y/long 10Y) gained as long-end yields defied hawkish Fed rhetoric .

1. Yield Curve Normalization: The Great Un-Inversion

2025 started with a key shift: the deeply inverted Treasury curve finally turned positive. After 2+ years of negative spreads, the 2-year/10-year gap hit +40 basis points by January. This wasn’t about economic euphoria though. Federal Reserve cuts and "bumpy inflation" narratives drove the move, flattening the short end while long yields stayed elevated. WisdomTree’s analysis noted this "un-inversion" remained historically shallow—far below pre-2022 slopes. Why? Markets priced moderate growth, not boom times. Short-term rates dipped as Fed pause hopes grew, but 10Y+ yields clung to 4.8%-5.0% on deficit fears. The normalization was fragile, not forceful .

2. Economic Context: Stagflation Whispers and Data Divergence

Beneath the curve’s shape, warning lights flashed. The New York Fed’s DSGE model slashed 2025 GDP growth to 0.3% (from 1.2%), citing tariff disruptions and weak Q1 data. Core PCE inflation forecasts jumped to 3.4% for 2025—near 12-year highs. Meanwhile, the Philadelphia Fed’s Q2 survey showed economists assigning a 37% chance of Q2 contraction, up from 15% in March. Consumer sentiment cratered (University of Michigan Index: 50.8 in April), while businesses froze capex. Yet jobs data perplexed: 152K monthly gains in Q1 clashed with recession models. This divergence—sticky inflation + cooling demand + strong payrolls—made curve interpretation messy .

3. The Term Premium Resurgence: Why Long Yields Defied Gravity

The 30-year yield breaking 5% in May wasn’t just about inflation. It reflected a term premium shock. Schwab’s analysis highlighted the ACMTP10 Index (measuring extra yield demanded for long-bond risk) spiking to 2011 highs. Two forces drove this:

- Tariff uncertainty: On-again/off-again trade policies (averaging 7%-17.8% vs. 2.5% in 2024) disrupted capital planning.

- Debt deluge: Projected $3T-$4T deficit expansion lifted Treasury supply fears.

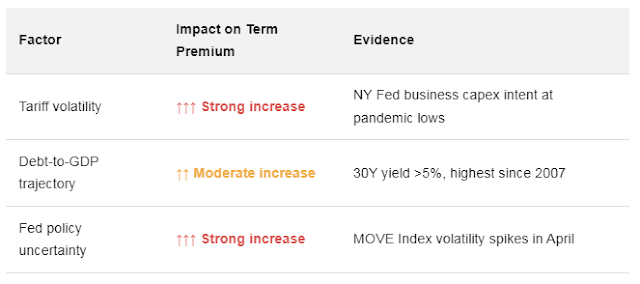

Table: Term Premium Drivers (2025)

This premium explained why long yields rose despite growth concerns—a historic decoupling .

4. Model Wars: Vasicek vs. DSGE in Forecasting Chaos

Quant teams grappled with two dominant frameworks in 2025:

- Two-Factor Vasicek: Split rates into short-term noise + structural trends. Calibrated to STRIPS data, it forecasted April’s "modest steepening" by weighting real-time options volatility. Its edge? Flexibility. When March’s curve kinked at 4Y, it adapted faster than regression models .

- Fed DSGE: The NY Fed’s dynamic model incorporated tariff shocks as "cost-push disturbances," lifting inflation forecasts preemptively. It nailed Q2’s stagflation tilt but underestimated long-end demand (pensions/insurers buying dips).

Survey models lagged. The Philadelphia Fed’s consensus underpredicted April CPI (actual 3.3% vs. 3.1% forecast) by overlooking tariff pass-through .

5. Tariffs as Curve Shapers: From Theory to Tantrums

April’s "Liberation Day" tariffs proved yield curves aren’t made in vacuum. Diamond Hill’s Q1 recap showed how 25% duties triggered:

- Front-end selloff: 2Y yields +12bps on import-price inflation fears.

- Long-end safety bids: 10Y yields fell 18bps as growth worries offset inflation.

This "bull flattening" broke textbook rules. Normally, tariffs lift both inflation expectations and the currency. But the dollar fell 7% as supply-chain chaos hurt U.S. growth bets. The takeaway? Tariffs steepen curves short-term (via inflation) but flatten them long-term (via growth destruction). By June, courts blocking tariffs eased pressure, but uncertainty kept vol elevated .

6. Tactical Plays: Trading the Curve’s Personality Shifts

2025’s yield curve wasn’t just academic—it minted winners and losers:

- Curve flattener (short 2Y/long 10Y): Gained as long bonds rallied despite Fed hawkishness.

- Front-end steepeners (long 2Y/short 5Y): Failed when intermediate yields defied selloffs.

- Volatility arb: MOVE Index options paid when April’s tariff news spiked implied vol 40%.

The Vasicek model’s April call exemplified this: It correctly avoided long-duration buys, instead favoring flatteners as the 10Y yield slid to 4.27%. Why? It read anchored term premia as a ceiling for long yields .

7. The Fed’s Invisible Hand: Data Dependence or Dependence on Data?

Powell’s 2025 mantra—“We react to data, not dots”—masked a curve management strategy. By holding rates at 4.25%-4.50% amid 3.3% core CPI, the Fed:

- Anchored short rates: Preventing 2Y yields from pricing runaway hikes.

- Ignored long-end fireworks: Letting 30Y yields breach 5% as “term premium noise.”

Minutes revealed unease though. Some members saw tariffs necessitating hikes, others cuts. This rift paralyzed forward guidance, forcing traders to lean harder on curve models. By June, futures priced just 1-2 cuts, down from 3 in March—a nod to the Fed’s reactive stance .

8. Forecasting in the Fog: What the Models Missed

No model aced 2025. Key blind spots included:

- Geopolitical bids: April’s 10Y rally amid Iran-Israel tensions.

- Real-money flows: Pension duration grabs at 5% 30Y yields.

- Sentiment spirals: Consumer inflation expectations hitting 6.7% without wage backing.

The DSGE model admitted its 2025 core PCE band (1.2%-5.5%) was “unusually wide”—a concession to unquantifiable risks. Vasicek’s rate-only focus overlooked credit spreads widening in May. Going forward, hybrid models (blending term structure + risk premia + sentiment) are gaining traction. As WisdomTree’s strategist noted: “Forecasts aren’t trades. They’re inputs for when markets lose the plot” .

Frequently Asked Questions

Q1: How long do yield curves stay inverted before un-inverting?

Historically, inversions last 6-18 months. The 2022-2024 episode spanned 22 months—the longest since 1980—before normalizing in Jan 2025 .

Q2: Can yield curves predict recessions if they’re distorted by QE?

Post-QE, inversions still signal contractions, but with lag. The 2023 inversion preceded 2025’s 46% recession probability, though timing got blurred by fiscal shocks .

Q3: Do tariffs steepen or flatten the yield curve?

Initially steepen (short-end inflation spikes), then flatten (long-end growth fears). In 2025, net flattening dominated as growth concerns overrode inflation .

Q4: Why use Vasicek over simpler regression models?

Vasicek’s two factors (transient + structural rates) adapt faster to regime shifts—like 2025’s tariff chaos. Regression assumes stable relationships, which broke post-2020 .

Q5: What’s the best curve-based recession signal today?

The 3m10y spread. It turned positive earlier and more reliably than 2s10s in 2025, avoiding false signals .

Comments

Post a Comment