Lockheed Martin faces significant pressure from agile defense startups despite record US defense budgets

Key Takeaways

- Lockheed Martin faces significant pressure from agile defense startups despite record US defense budgets, leading to stagnant stock performance .

- Internal bureaucracy and risk aversion stifle innovation at major contractors, while startups like Anduril and Palantir embrace rapid iteration and failure .

- Lockheed responds through AI integration (LMText Navigator, AI Factory), mission-focused upgrades (ER GMLRS, Black Hawk digital backbone), and startup collaborations like "AI Fight Club" .

- The "valley of death" – the gap between prototype development and mass production – claims 40% of small suppliers over the past decade, weakening traditional contractor ecosystems .

- Political influence remains a core strategy, with Lockheed’s PAC donating $256,500 to 147 lawmakers during 2022 Ukraine aid debates .

The Startup Disruption: Why Lockheed’s Missing Out on Defense Budget Booms

Honestly, it’s kinda wild—global defense spending’s hitting records, but Lockheed Martin’s stock? Basically stuck where it was back in 2022. That’s like, three years without real growth, even with wars and tensions everywhere. Investors expected way better, but nope. The problem ain’t the money available; it’s who’s grabbing it. New, agile startups focused on specific tech—drones, AI, cyber—are taking chunks of the market that used to belong to giants like Lockheed. These smaller companies move fast, build products quick, and don’t get bogged down in layers of approvals .

Meanwhile, Lockheed’s dealing with supply chain headaches and can’t really raise prices much, so profits stay flat. And localization’s a thing now—countries want their own defense industries, not just buying F-35s off the shelf. So even though defense stocks globally are up, US contractors like Lockheed are lagging. One analyst called it a "low-risk, low-reward" hold right now, which feels pretty accurate given how things are going .

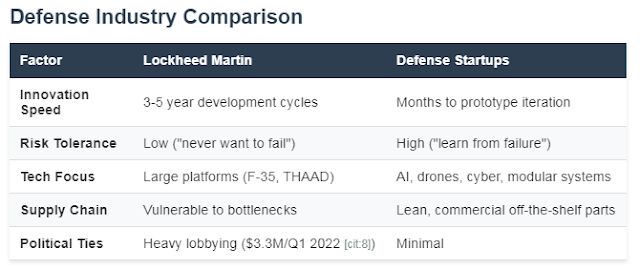

Table: Traditional Contractors vs. Startup Challengers

Mission Integration: Lockheed’s Trying to Adapt (But Is It Enough?)

Lockheed’s not ignoring the problem, though. Their big push now is "mission integration"—connecting weapons, data, and soldiers faster. Like, take the new ER GMLRS rocket: it doubles the range of older rockets to 150km, works with existing HIMARS launchers, and entered production this year. That’s practical, cause armies don’t need whole new systems . They’re also upgrading old platforms instead of just building new ones. The UH-60M Black Hawk’s getting a digital backbone kit so it can talk to drones and ground systems, plus a better engine. That’s smart, keeps costs down while adding capabilities for places like the Indo-Pacific where range matters alot .

Then there’s targeting pods. The Sniper pod—usually just for spotting targets—now acts like a comms hub. It lets F-35s share data with older F-16s or ground troops, so everyone sees the same threat picture. They’re using Mobile Ad-hoc Networks (MANET) and 5G.MIL® to make this work securely. It’s clever, making legacy gear useful in new ways . But...is it enough to keep up? Startups are building networks from scratch, not retrofitting. Lockheed’s playing catch-up here, honestly.

|

Innovation Culture: Why "Fail Fast" Doesn’t Fly in the Pentagon

Here’s the real kicker: Lockheed’s own VP, Brian O’Connor, basically admitted their culture’s the problem. At a conference in Alabama, he said big defense firms "never want to fail" because it hurts their stock price. That fear of failure means they over-analyze everything—spending "six months analysing" what startups just try. Meanwhile, companies like SpaceX blow up rockets and try again next week. If NASA did that, they’d "still be on the launchpad," joked Congressman Carlos Gimenez .

The Pentagon’s process doesn’t help. Getting a program greenlit feels like a "rectal exam," according to Gimenez. Requirements take years to finalize, and by then, the tech’s outdated. This rigidity pushed smaller suppliers out—40% of "mom and pop" suppliers left the industry in the last decade. That’s a huge deal, cause those small guys often drive innovation . Plus, finding specialized engineers? Almost impossible. Radiation engineers for missile work are super rare, and universities aren’t producing enough AI researchers compared to China . So yeah, the system’s kinda broken.

Startup Collaboration: How Lockheed’s Borrowing Silicon Valley’s Playbook

Alright, so Lockheed’s trying to act more startup-like, or at least work with them. Take Oracle’s new defense ecosystem—it gives startups secure spaces, help with contracts, and access to cloud tools. In return, Oracle (and partners like Lockheed) get early looks at new tech. Kim Lynch from Oracle put it straight: "We’re seeing... the barriers to entry are decreasing... but there still is an upfront investment" startups can’t always handle .

Lockheed’s also got this "AI Fight Club" thing. Sounds flashy, but it’s practical: a digital sandbox where startups test AI models against military scenarios. Lockheed provides the testing setup they couldn’t afford alone. John Clark from Lockheed said they "want the best things in our weapon systems," and this helps vet tech beyond "glossy marketing brochures" . It’s smart—they learn from startups without betting the farm.

But there’s tension here. Startups like Raft want to "change the way the fight is won" but struggle to scale. Founder Shubhi Mishra points out tech often can’t handle classified networks without being "stripped down" . Lockheed’s infrastructure could bridge that gap, but only if they truly empower these partners, not absorb them.

AI & Autonomy: Lockheed’s Betting Big on Silicon Brains

AI’s where Lockheed’s pushing hardest, honestly. They’ve built this "AI Factory"—a platform for developing AI apps across the company. Over 8,000 engineers use it to speed up everything from aircraft design to predictive maintenance. Greg Forrest, their AI director, talks about "pushing frontiers" for next-gen warfare .

Skunk Works®, their legendary R&D division, is all-in on autonomy. Projects like Athena use AI for laser targeting, while crewed-uncrewed teaming lets Black Hawks control drone swarms. Dan Morrison, an engineer there, says they’re "refining autonomous behaviors" so humans and machines work together better .

Then there’s generative AI. Tools like LMText Navigator help engineers write code or analyze data faster. It’s powered by NVIDIA’s supercomputers, which is cool, but also raises questions—can old-school contractors really out-innovate AI-native startups? Lockheed’s also working with DARPA on the AIR Program: $4.6 million for AI that helps jet pilots make split-second decisions in combat using "surrogate models" of enemy gear .

Lockheed Martin’s Key AI Initiatives

- LMText Navigator: Internal generative AI for code/data tasks

- T-TAURI: Machine learning for predicting spacecraft failures

- AI Fight Club: Startup testing for military-grade AI

- DARPA AIR Program: AI for jet pilot decision aids

- MATRIX Autonomy: Black Hawk helicopter autonomy kits

Political Leverage: Lobbying’s Still Their Core "Innovation"

Let’s be real—while startups tech-up, Lockheed’s playing the influence game hard. In April 2022, during the huge Ukraine aid debates, their PAC donated $256,500 to nearly 150 lawmakers. That included key folks on the Armed Services Committees, like Chairman Adam Smith ($2,500) and Senators like Tammy Duckworth and Mark Kelly .

It’s strategic. Lockheed makes stuff the military needs fast during crises, like Javelin missiles. When Ukraine blew through thousands of Javelins, Lockheed and Raytheon landed $309 million in new contracts. Their PAC spending spiked at the perfect time to shape those decisions .

They also spend millions quarterly on lobbying—$3.3 million just in Q1 2022. Compare that to a startup like Anduril, and it’s night and day. Lockheed’s got deep ties, but that might backfire. As Rep. Gimenez warned, the US must "face the fact that China will cut us off" from critical materials. Relying on influence over innovation is risky long-term .

Future Outlook: Can a Giant Learn to Dance?

So where does this leave Lockheed? They’re trying, sure. Upgrading old systems like the Black Hawk with digital kits, using AI to speed up design, even copying startup tactics with "Fight Club." But culture’s a beast to change. As their VP admitted, failure’s still taboo, while startups live by it .

The "valley of death" between prototype and production keeps killing small suppliers, which hurts Lockheed too. Without those innovators, their supply chain weakens. And competing for engineers against Silicon Valley? Super tough when China’s pumping out AI researchers .

Lockheed’s got advantages—scale, political heft, and iconic products like the F-35 (26% of 2024 revenue ). But startups are winning the agility war. To survive, Lockheed must let partners like those in Oracle’s ecosystem lead sometimes, not just absorb them. As Raft’s CEO said, "Size doesn’t matter" anymore—it’s about solving specific problems fast . If Lockheed embraces that, maybe they’ll stop lagging behind the budgets meant for them.

Frequently Asked Questions

Why is Lockheed Martin stock underperforming despite high defense spending?

Supply chain issues, inability to raise prices significantly, and competition from agile startups capturing market share in key tech areas like drones and AI have limited growth. Political delays in contract approvals also play a role .

What is "mission integration"?

Lockheed’s strategy of connecting existing weapons, sensors, and data systems (like upgraded Sniper pods or Black Hawk helicopters) to work together faster, avoiding costly new platform development .

How does Lockheed work with startups?

Through initiatives like "AI Fight Club" (testing AI for military use) and partnerships with Oracle’s defense ecosystem, providing startups with secure testing infrastructure and contract support .

What did Lockheed’s VP mean by "learn to fail"?

Brian O’Connor criticized defense giants’ risk aversion, arguing that over-analysis stifles innovation. Startups iterate quickly through failures, while contractors fear stock impacts .

Will AI replace Lockheed’s traditional aircraft business?

Not immediately—the F-35 still drives 26% of revenue. But AI is becoming central to upgrades (e.g., autonomous Black Hawks) and new systems, signaling a gradual shift .

Comments

Post a Comment