Key Takeaways

- Cost dispute: Trump claimed Fed renovations cost $3.1B; Powell corrected him, noting $2.5B was accurate and Trump’s figure included unrelated projects .

- Firing threats walked back: Trump called firing Powell “unnecessary” despite earlier threats, signaling temporary retreat .

- Rate pressure continues: Trump publicly demanded rate cuts during the tour, linking them to housing affordability .

- Renovation justifications: Fed cited asbestos removal, security upgrades (blast-proof windows), and inflation as key cost drivers .

- Legal limits: Experts argue renovation overruns don’t meet the “for cause” threshold required to fire a Fed chair .

The Confrontation: $3.1B Claim Meets Instant Pushback

Trump wasted no time setting a combative tone. Standing beside Powell in hard hats at the Fed’s renovation site, he waved a document claiming costs had ballooned to $3.1 billion, far above the publicly stated $2.5 billion. Powell’s reaction was swift and visible: shaking his head, eyes closed in clear irritation. “I’m not aware of that,” he stated flatly. When Trump handed him the paper, Powell scanned it and pinpointed the error: Trump had folded in costs from the Martin Building, a separate project completed five years earlier. “It’s not new,” Powell emphasized, handing the paper back .

The moment crystallized their strained dynamic. Trump, the developer-president, framed the overruns as incompetence; Powell, the technocrat, rebutted with facts. Reporters noted Powell’s uncharacteristic agitation, a departure from his usual stoicism .

Behind the Renovation Chaos: Why Costs Skyrocketed

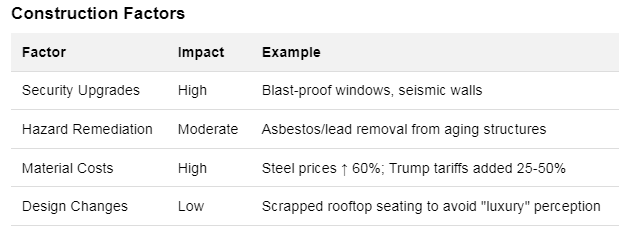

So why did the renovation budget jump from $1.9B to $2.5B? Fed staff explained during a pre-tour press walkthrough:

- Historic preservation: The 1930s Eccles and Constitution Ave buildings required painstaking asbestos/lead removal and structural reinforcement .

- Security mandates: Post-9/11 standards demanded blast-resistant windows and “progressive collapse” safeguards (limiting damage from attacks) .

- Inflation + tariffs: Steel prices surged 60% since 2019, compounded by Trump’s 25–50% tariffs on imported materials .

- Underground work: D.C. height restrictions forced mechanical systems and parking into costly subterranean levels .

Table: Key Renovation Cost Drivers

White House officials dismissed these explanations. Budget Director Russ Vought accused Powell of “mismanagement” and violating oversight rules, a claim Powell denied, noting the Fed’s inspector general had reviewed the project twice .

Interest Rates: The Real Battle Behind the Hard Hat Photo Op

While renovations dominated visuals, interest rates fueled Trump’s visit. He told reporters: “I’d love him to lower interest rates. Other than that, what can I tell you?” . His demand was unambiguous: slash rates by 3 percentage points to boost housing access and reduce U.S. debt interest payments, which hit $1.1 trillion in 2024 .

Powell’s resistance stems from inflation concerns. June 2025 data showed prices rising at 2.7% annually, faster than the previous month. With Trump’s tariffs threatening further inflation, the Fed prefers holding rates steady (currently 4.25%-4.5%) until September cuts seem safer .

Trump’s pressure isn’t subtle. He’s branded Powell “Too Late” for delayed cuts and even asked GOP lawmakers if he should fire him . Yet markets expect no rate change at the July 30-31 meeting, signaling Powell’s independence holds, for now .

Firing Threats: From “Terminate!” to “Unnecessary”

Trump’s threats to oust Powell peaked days before the visit. He showed House Republicans a draft firing letter, asking, “Should I send it?” . Legal experts immediately flagged hurdles:

- Fed chairs can only be removed “for cause” (e.g., crimes, ethics breaches), not policy disputes or construction overruns.

- A firing would trigger market chaos and legal challenges, potentially reaching the Supreme Court.

By the tour’s end, Trump softened. “To do that is a big move, and I just don’t think it’s necessary,” he conceded, adding Powell might “do the right thing” on rates . The retreat suggests advisors warned of economic fallout, though Trump left wiggle room by citing “fraud” as a potential cause .

Powell’s Defense: Security and Statute vs. “Palace of Versailles” Jabs

Republicans mock the project as a “Palace of Versailles,” implying lavish excess. Powell’s rebuttals are precise:

- No VIP perks: The contested elevator? Expanded 18 inches for accessibility, not exclusivity. Marble additions? Requested by Trump-appointed arts commissioners .

- Cost transparency: The Fed published a virtual tour showing asbestos removal and budget documents attributing overruns to inflation .

- Legal independence: The Fed isn’t bound by National Capital Planning Commission reviews, its compliance is voluntary .

Powell’s calm under fire reflects his stance: “We will do what we do strictly without consideration of political... factors” .

Why This Visit Broke 19 Years of Presidential Precedent

Trump is the first president since George W. Bush in 2006 to enter the Fed’s headquarters. Historically, presidents avoided such visits to safeguard the Fed’s independence . Trump’s trip inverted that norm, using the renovation as pretext to pressure Powell on camera.

The spectacle also diverted attention from the Epstein files controversy dogging Trump’s administration . While touring cement mixers, Trump deflected a question about Epstein by pivoting to Obama: “He was on the island!” .

Legal Firewalls: Can Trump Actually Fire Powell?

Short answer: Unlikely. The Federal Reserve Act mandates “cause” for removal, interpreted as malfeasance, not policy disagreements. Renovation disputes don’t meet that threshold . Even Trump allies like Sen. Tim Scott (who attended the tour) haven’t endorsed termination .

Powell’s term ends in May 2026. Trump can replace him then, but for now, the chair’s defiance signals institutional resilience .

What’s Next: Rate Cuts, Lawsuits, or More Theater?

- September rate cut: Markets predict the Fed will lower rates then if inflation cools .

- Renovation reviews: The Fed’s inspector general may release new findings, fueling GOP attacks.

- Election impact: Trump could escalate pressure if rates don’t fall by November 2026 midterms .

Powell’s term ends in 10 months. Whether Trump reappoints him seems improbable, but so did a president touring the Fed in a hard hat.

Frequently Asked Questions

Why did the Fed renovation cost so much?

Primarily due to inflation (steel prices ↑ 60%), security requirements (blast-proof windows), and unexpected hazards like asbestos in the 90-year-old buildings .

Can Trump legally fire Jerome Powell?

Only “for cause,” like illegal conduct. Cost overruns or rate disagreements don’t qualify. Legal experts say firing him would spark immediate lawsuits .

What interest rate does Trump want?

A 3-point cut, taking the benchmark rate near 1.25%-1.5%. He claims it would reduce U.S. debt payments and mortgage costs .

Did Powell agree with Trump’s $3.1B cost figure?

No. He noted Trump erroneously included $600M from a separate, completed project (the Martin Building) .

Will the Fed cut rates in July 2025?

Unlikely. Inflation rose to 2.7% in June. Most analysts expect cuts starting in September .

Comments

Post a Comment