Key Takeaways

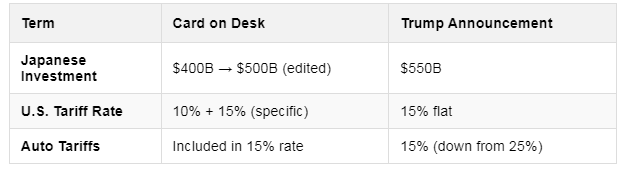

- Handwritten edits on Trump’s trade deal note showed $400B crossed out, replaced with “500” , later became $550B in announcements .

- Tariff discrepancies: Card listed 10% general + 15% industry-specific rates; Trump declared flat 15% reciprocal tariff .

- No official explanations from the White House on edits; Commerce Secretary Lutnick took credit for the board but ignored alterations .

- Japanese officials framed the $550B investment as a cap, hinting at slow implementation of non-beneficial projects .

The Card Itself

A photograph posted by Dan Scavino, Trump’s deputy chief of staff, showed a white note card on the Resolute Desk. The marker bled through the cardboard. “$400B” stood printed neatly. Someone had slashed through the “4” and scribbled “500” above it. Below that, two tariff figures: 10% across the board, 15% for cars, drugs, chips. Trump announced 15% flat hours later. And $550 billion. The math didn’t stick. No one explained the gap between the 500 on the card and the 550 in his Truth Social post. Commerce Secretary Howard Lutnick told Bloomberg he created the board. He didn’t say who changed the numbers .

The Announcement

Trump called it the largest trade deal in history. Japan would pour $550 billion into the U.S. Create hundreds of thousands of jobs. Pay 15% tariffs on goods shipped to America. Open its markets to American rice and cars. Reciprocal, he said. The Nikkei stock index jumped 3.7% the next morning. Auto stocks led the charge, Toyota, Honda, Nissan surging. Taruhoo Ushiba, Japan’s negotiation lead, tweeted a photo of himself pointing at a portrait of Trump and Prime Minister Shigeru Ishiba. “Mission accomplished,” he wrote. Back in Washington, the card on Trump’s desk told a murkier story .

The Numbers Game

The $400 billion became $500 billion became $550 billion. No paper trail connected the jumps. Treasury Secretary Scott Bessent suggested Japan’s auto tariff dropped to 15% (from 25%) because they offered “innovative financing” for U.S. projects. Wall Street analysts weren’t buying it. Piper Sandler’s note to clients warned Japan saw $550B as a ceiling, not a target, including loan guarantees. “They will slow walk whatever investments they don’t think are in their own interest,” it read. Rice figured in the deal too. Japan bought $114 million of U.S. rice this year. The 2021 USTR report had called Japan’s import system “nontransparent.” Now, suddenly, it was open .

Table: Deal Terms vs. Announcement

Auto Wars

Cars anchored this deal. Japan exports $148 billion in goods to the U.S. yearly. A quarter of that comes from wheels and parts. Trump had ranted for years about Japan not buying American cars. “We didn’t give them one car in 10 years,” he’d said. Last year, Japan imported 16,707 U.S. cars. The new 15% tariff undercut the 25% rate slapped on EU and UK autos. Matt Blunt of the American Automotive Policy Council (Ford, GM, Stellantis) called it a “bad deal for U.S. auto workers.” Cheaper tariffs for Japanese imports than North American-made vehicles with U.S. parts? It stung. Meanwhile, Japan’s auto lobby toasted with sake .

Table: Auto Tariff Comparison

Rice and Wrath

“They won’t take our RICE,” Trump posted on Truth Social weeks before the deal. Japan had a shortage. It bought $298 million of U.S. rice last year. The 2021 USTR report accused Japan of blocking consumer access. Now, suddenly, rice flowed. Taruhoo Ushiba stressed agriculture wasn’t sacrificed. U.S. rice farmers gained a sliver of Japan’s market. The rest of the deal? Steel and aluminum tariffs stayed at 50%. Pharmaceuticals and semiconductors got the 15% rate. Bessent called it “a different kind of deal.” No one mentioned the card .

The Players

Trump called himself “negotiator in chief.” Howard Lutnick (Commerce) took credit for the board. Scott Bessent (Treasury) spun the auto tariff cut as a win. Across the Pacific, Shigeru Ishiba celebrated Japan securing “the lowest rate ever” for a trade-surplus nation. He faced pressure to resign after his party’s election loss. This deal bought time. Ryosei Akazawa, Japan’s negotiator, beamed in his White House photo. Shigeto Nagai (Oxford Economics) said the investment would “restore U.S. manufacturing.” Andy Laperriere (Piper Sandler) whispered about Japan’s slow-walk .

The Unanswered

Who changed the $400B to $500B? Why did Trump say $550B? The White House never answered CNBC’s questions. Lutnick dodged Bloomberg. The card’s edits hinted at a last-minute scramble. Trump’s August 1 deadline for global tariff hikes loomed. Europe faced 30%. South Korea and India sweated. Japan slid under the wire with 15%. The investment figure floated like a drunk’s promise. $550 billion. Ninety percent of profits to the U.S. Jobs. Growth. The card, though, the card felt real. Felt human. Someone’s hand gripping a marker, scratching out a “4,” writing “500.” No one explained it. No one needed to .

What Comes Next

August 1 ticks closer. EU talks hang on a 30% tariff threat. Japan’s $550 billion? Watch for foot-dragging. Auto stocks celebrate today. U.S. automakers plot retaliation. Rice shipments may inch up. The Alaska gas pipeline, mentioned offhand by Trump, waits for Japanese cash. Prime Minister Ishiba’s government examines the fine print. Markets soared on the news. Reality arrives later. The card’s edits tell the truth: deals bend until the pen lifts .

Frequently Asked Questions

Why did Trump’s trade deal card show $400B crossed out?

The photo revealed “$400B” printed on the card, manually altered to “$500B.” Trump later announced $550B. The White House never clarified the reason for the edits or the final figure discrepancy .

What tariffs will Japan pay under the new deal?

Trump declared a flat 15% rate on all Japanese goods. The card on his desk listed 10% general tariffs plus 15% for autos, pharmaceuticals, and semiconductors, suggesting internal confusion about the terms .

How will Japan’s $550B investment work?

Japanese officials framed it as a maximum cap covering equity, loans, and guarantees for projects in sectors like semiconductors. Analysts expect Japan to “slow walk” investments not in its self-interest .

Did the deal benefit U.S. automakers?

No. The American Automotive Policy Council (representing Ford, GM, Stellantis) criticized the 15% tariff on Japanese imports, lower than the 25% rate imposed on some North American-made vehicles .

What remains unresolved?

Steel/aluminum tariffs (still 50%) and agricultural details. The EU faces a 30% tariff threat if no deal is reached by August 1 .

Comments

Post a Comment