Centene (CNC) Q2 2025: Surprise Loss on Medicaid/ACA Costs, Revenue Beats; Stock Rebates on 2026 Outlook

Centene Q2 Loss Highlights Rising Costs

Key Takeaways

- Centene posted a $253M Q2 loss, flipping from a $1.1B profit in 2024 .

- Medical cost ratio (MCR) surged to 93%, far exceeding Wall Street’s 89.3% forecast .

- Stock plunged 14.5% premarket, hitting a decade low and dragging down peers Elevance Health and Molina Healthcare .

- Loss drivers: Medicaid behavioral/home health costs, ACA risk-adjustment revenue cuts, and high-cost drugs .

- Corrective action: Premium hikes for 2026 ACA plans in "substantial majority" of states .

The Earnings Shock

Centene bled red. $253 million vanished in Q2. Last year? A crisp $1.1 billion profit . Premium revenue climbed to $42.5 billion, up 18%, but medical costs devoured it . The street expected an $0.86 per share profit. Instead, Centene coughed up a $0.16 loss . Analysts stared at their screens. Julie Utterback at Morningstar called the 93% medical cost ratio "surprisingly high" . All business lines burned. The ACA marketplace? The biggest culprit .

Table: Centene Q2 2025 Financial Snapshot

What Drove Costs Through the Roof

Three demons tormented Centene. First: Medicaid. Behavioral health visits. Home care. Specialty drugs, expensive. States like New York and Florida screamed trouble . Second: The ACA risk-adjustment debacle. Wakely, an independent actuarial firm, crunched data from 22 states. Found "significantly higher morbidity." Centene slashed its 2025 risk-adjustment revenue estimate by $1.8 billion . Third: Medicare Advantage. A premium deficiency reserve built, reserving for future losses . CEO Sarah London called it a "shifting landscape" . The landscape shifted into a sinkhole.

The Industry Contagion

Centene isn’t alone. The whole sector’s wheezing. Elevance Health cut its 2025 profit forecast last week. Medicaid costs. ACA plans bleeding . Molina Healthcare trimmed earnings guidance too. All three government programs, Medicaid, Medicare, ACA, biting back . UnitedHealth suspended its outlook in May. Medicare Advantage headaches. Humana and CVS Health’s Aetna bled last year. CVS is exiting ACA exchanges entirely, dumping a million members into 2026 uncertainty . Centene’s stock crash? A 55.8% nosedive this year. The S&P 500’s worst performer .

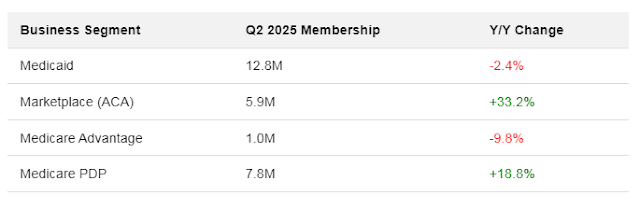

Table: Health Insurer Membership Shifts (Q2 2025 vs. Q2 2024)

Leadership’s Pivot, Too Late?

London’s statement felt canned. "Disappointed." "Working with urgency." "Restore earnings trajectory" . Actions? Centene yanked its 2025 guidance on July 1. Investors fled. Stock dropped 20% that day . Now, they’re refiling 2026 ACA premiums. Asking states for hikes. "Corrective pricing actions," London called it . States covering a "substantial majority" of Centene’s ACA members will see requests . The new 2025 EPS outlook? A grim $1.75 per share, down from $7.25 .

The Road Ahead, Brutal

Three hurdles glare. Medicaid redeterminations. States reassessing eligibility post-pandemic. Sicker members stick. Costs jump . The ACA subsidy cliff. Federal subsidies expire end of 2025. Centene’s prepping two rate sets per state, one with subsidies, one without . Policy chaos. Trump-era rules could gatekeep ACA enrollment. CMS proposals might demand proof of subsidy eligibility upfront. "High single-digit price increases" loom, CFO Drew Asher warned . Centene priced 2025 ACA plans aggressively. $0 premiums. Added 1.2 million members. Now, those cheap plans hemorrhage cash. The band-aid? Premium hikes. The wound? Deep.

Frequently Asked Questions

Why did Centene post a $253M loss?

Rising medical costs, behavioral health, home care, high-cost drugs, plus a $1.8B cut to ACA risk-adjustment revenue triggered the loss .

How high is Centene’s medical cost ratio?

93% in Q2 2025, meaning 93 cents of every premium dollar went to medical claims. Wall Street expected 89.3% .

What’s happening with Centene’s stock?

Shares fell 14.5% premarket on the loss news, hitting a decade low. The stock is down 55.8% year-to-date .

Is Centene raising premiums?

Yes. The company is requesting premium increases for 2026 ACA plans in states covering most of its membership .

Are other insurers struggling too?

Yes. Elevance Health, Molina Healthcare, and UnitedHealth have all warned of or reported rising costs in government-backed plans.

Citing My Link Sources:

- https://www.forbes.com/sites/brucejapsen/2025/07/25/centene-reports-253-million-loss-amid-health-insurer-cost-struggles/

- https://www.beckerspayer.com/payer/centene-posts-253m-loss-in-q2/

- https://www.reuters.com/business/healthcare-pharmaceuticals/centene-posts-surprise-loss-medical-costs-surge-shares-slump-2025-07-25/

- https://news.az/news/centene-reports-surprise-loss-as-medical-costs-rise-shares-fall-14

- https://www.cnbc.com/2025/07/25/centene-posts-surprise-loss-as-medical-costs-surge.html

- https://www.morningstar.com/news/marketwatch/2025072561/centene-reports-a-rare-loss-as-medical-costs-surge-and-the-stock-hits-a-decade-low

- https://www.beckerspayer.com/payer/centene-posts-253m-loss-in-q2/

- https://www.investing.com/news/stock-market-news/centene-stock-tumbles-after-withdrawal-of-2025-guidance-4120100

- https://www.reuters.com/business/healthcare-pharmaceuticals/health-insurer-centene-reports-surprise-loss-rising-medical-costs-2025-07-25/

Comments

Post a Comment